Maximal Extractable Value (MEV) plays an important role in decentralized finance (DeFi), affecting how traders execute transactions on blockchain networks. MEV refers to the extra value block producers, such as miners or validators, can gain by adjusting the order or inclusion of transactions within a block. This manipulation often leads to significant profits for block producers but poses serious challenges for everyday traders.

Understanding MEV is vital because it impacts transaction costs, trade execution, and the overall efficiency of DeFi markets. This article will explain how MEV works, examine its impact on traders, and discuss ways to reduce these risks effectively. By the end, you’ll clearly understand MEV and its impact on traders.

What Is MEV?

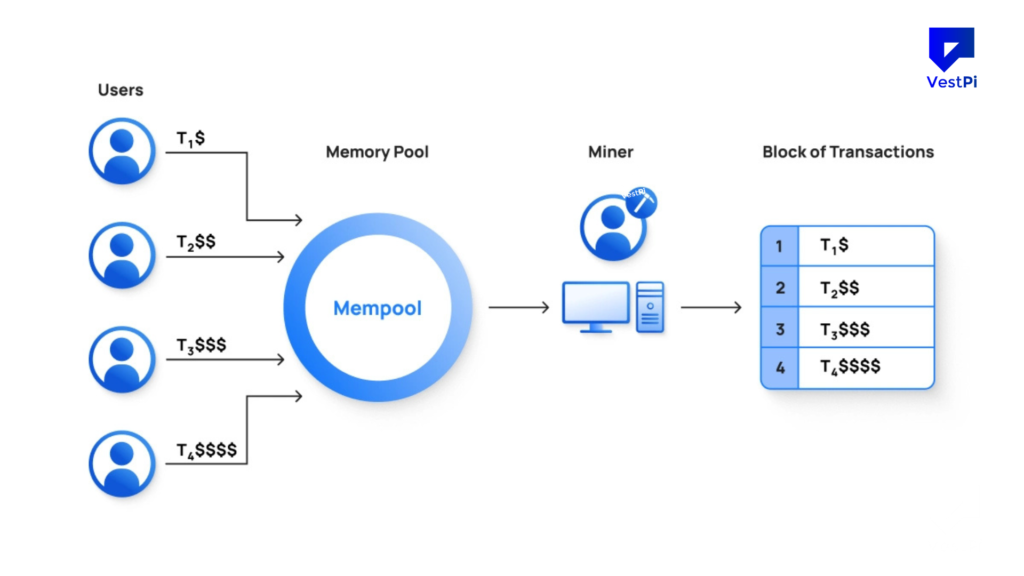

The greatest extra value that block producers and specialized bots can obtain by altering the sequence of user transactions within a block is known as MEV. The majority of blockchains use transparent mempools, which is why they exist. Before they are completed, pending transactions are visible to anyone.

You can arrange trades around other people’s deals if you can see them before they go live on the chain. As soon as they become undercollateralized, you can liquidate their positions, trade on price movements they cause, or jump in front of them. Someone in charge of transaction ordering may profit from any of these activities.

Miners had direct power over ordering in the early days of Ethereum. They could rearrange the block such that the most lucrative transactions come first. Specialized searchers emerged as DeFi expanded. These are bots that search the mempool for lucrative trends, like users that create large slippage or arbitrage gaps between DEX prices. After that, bundles of transactions that capture that value are sent by the bots.

Three primary responsibilities are now involved in block production in proof-of-stake Ethereum. Searchers generate transaction bundles and identify lucrative prospects. These bundles are gathered by builders, who then create candidate blocks.

Proposers, another name for validators, decide which blocks to add to the chain. Proposer-builder separation is the term for this division of responsibilities, which is now achieved via middleware such as MEV-Boost.

Types Of MEV Extraction

MEV is never a single trick. It is a bundle of techniques built around controlling transaction ordering and inclusion.

1. Front-Running

Your big exchange is seen by a bot that keeps an eye on the mempool. Then, in order to get its deal executed first, it files its own transaction with a greater gas fee or priority. The bot makes money when the price changes in reaction to your order.

2. Sandwich Attacks

On DEXes, sandwich attacks are the most frequent user-harming MEV. The attacker makes two trades immediately prior to and immediately following your exchange. The price is pushed against you by the first trade. Then, the rate at which your request is executed decreases.

The attacker’s profit is locked in, and the price is reset in the second deal. How much they can take advantage of you depends on your slippage setting.

3. Back-Running

When a bot makes a trade just after a known price-moving transaction, this is known as back-running. It doesn’t change your price beforehand. It just responds more quickly and seizes the chance for arbitrage or rebalancing that arises after your trade.

4. Liquidations

One of the main sources of MEV in lending protocols is liquidations. Anyone can liquidate a borrower’s position and receive a bonus when it drops below the necessary collateral level. Bots compete to file a legitimate liquidation transaction first. Due to the large number of unsuccessful attempts, this competition not only generates revenue but also wastes a lot of gas.

5. Arbitrage

The oldest and least contentious type of MEV is arbitrage. Price disparities between DEXes or between DEXes and centralized exchanges are exploited by bots. A bot can purchase on the less costly arena and sell on the more expensive one if a token is trading at various prices. Although this aids in price alignment, someone’s deal still generates the profit.

6. Cross-Chain MEV

Cross-chain MEV is becoming more and more significant this year. While a bot makes money from timing gaps between bridge messages or price changes on separate chains, a trader may move assets across a bridge. MEV on L2s and bridges is already large and continues to expand, according to research.

Almost anything you do on-chain can be impacted by MEV. You may learn about MEV techniques through simple swaps, intricate DeFi positions, NFT mints, and cross-chain transfers. If the deal size and slippage make it profitable to target, even a simple attempt to sell cryptocurrency on a well-known DEX may wind up inside a bot’s bundle.

How MEV is Impacting Traders

MEV frequently appears as a hidden expense rather than an obvious charge for individual consumers. It manifests as higher prices, odd surges, or a pattern of unsuccessful transactions.

Deteriorated execution quality is one of the most significant consequences. Your ultimate fill price in a sandwich attack is lower than what you saw at the time of transaction signing. When you buy, you pay more, or when you sell, you get paid less. Instead of remaining in your position, the attacker gains additional value.

This invisible charge can, in extreme circumstances, equal one to five percent of trading value on volatile pairs, particularly for large orders with significant slippage, according to studies and dashboards that monitor DEX flows.

Analysts believe that MEV extraction across Ethereum has already cost users more than $1 billion and is still increasing annually at the ecosystem level.

Additionally, MEV makes the gas markets noisier. Many overlapping transactions with large gas bids are sent when multiple bots vie for the same opportunity. Even though the majority of those transactions fail, blockspace is still used.

How MEV Impacts Networks

Validator centralization is one issue. Validators have a strong incentive to deploy cutting-edge MEV infrastructure and link with the top builders because MEV can significantly increase each block’s revenue. More MEV can be captured by larger operators with better equipment.

Over time, centralization risk may rise as smaller validators feel pressured to join staking pools or outsource more of their operations. Another consequence is network congestion.

Compared to regular users, MEV bots frequently send a lot more transactions. Several bots flood the mempool with marginally different bids for every opportunity. Even though the majority of these transactions never land, they nevertheless use resources.

Flashbots and other researchers have noted that spam from MEV bots has consumed a significant portion of recent throughput advances on various networks, such as Base.

Time-bandit attacks are another concern for security researchers. A validator may be motivated to attempt to rearrange the chain in order to catch MEV opportunities if they are sufficiently substantial within recent blocks. This is still primarily a theoretical issue on Ethereum’s mainnet today, but it is a major topic in conversations about protocol architecture.

Ethereum has implemented proposer-builder separation with MEV-Boost to reduce the most hazardous consequences. In this system, validators select the most profitable block provided by a relay after specialized builders compete to construct blocks.

Protecting Yourself From MEV

You can lessen your exposure to the most dangerous types of MEV, but you cannot eliminate them from public blockchains. Sending your transactions via MEV-aware protection services instead of the public mempool is one of the best protections.

Instead of broadcasting deals publicly, Flashbots Protect provides a unique RPC endpoint that delivers them directly to a group of builders. This stops common front-running and sandwich assaults, and in certain situations, it can even return a portion of the MEV to the user.

Another well-liked RPC for protection is MEV Blocker. Your transactions are sent to a network of reliable builders and searchers, who are permitted to back-run them but not front-run or sandwich them. They receive up to 90% of any back-running profit in exchange.

In 2023, more than thirty Ethereum projects, including CoW Swap and Gnosis, contributed to the creation of MEV Blocker. A lot of these programs are simple to use. You can route trades through a private or protected mempool by adding the custom endpoint to your cryptocurrency wallet‘s settings.

These features are now supported by default in some wallets and DeFi front ends, so all you have to do is toggle a setting. DEXes that are made to withstand MEVs are another option. For instance, CoW Swap employs intent-based trading and batch auctions to compel solvers to provide users the best deal.

What MEV Landscape Looks Like?

Today, MEV extraction is no longer dominated by hobbyist bots. Advanced MEV extraction infrastructure is being operated by professional firms, prop-trading desks, and traditional finance players.

According to reports, the average daily MEV earnings on Ethereum alone have reportedly reached hundreds of thousands of dollars in recent years. There is fierce rivalry for that kind of money.

These days, AI and machine learning systems are becoming more and more important. In order to forecast which DeFi positions are nearing liquidation, which pools are expected to witness significant trades in the near future, or how cross-chain price gaps will behave during particular events, models can examine past data.

These technologies increase the accuracy and difficulty of identifying MEV techniques. Additionally, cross-chain MEV is growing. New types of timing and oracle risk emerge as more users bridge assets between Ethereum, rollups, and alternative L1s.

Price changes or bridge messages that haven’t yet been settled on other chains can be acted upon by searchers. Large lower-bound estimations for MEV on L2s and sidechains have already been highlighted by research.

Bottom Line

Many of the odd things you see in DeFi are caused by MEV. It explains why gas spikes around specific blocks, why a swap fills at a lower price than anticipated, and why liquidations appear to occur as soon as a position reaches its threshold.

It has become a multibillion-dollar phenomenon this year that impacts large networks as well as individual dealers. MEV cannot be removed from permissionless, transparent blockchains.

Value extraction will be possible as long as transactions are stored in public mempools and block ordering is managed. You can understand how it functions and modify your tactics. The worst losses can be minimized by using MEV-aware RPCs, trading on MEV-resistant DEXs, tightening slippage, and using calmer market times.

Understanding MEV transforms an invisible fee into a visible risk that you can control, regardless of whether you are a frequent DeFi user or someone who occasionally enjoys making cryptocurrency purchases online. Professional searchers will still be able to compete, and it won’t make every trade flawless.