Crypto vesting is a popular method for ensuring long-term commitment among project participants. It ensures that the project owners have a financial incentive to continue developing the project, which boosts potential investors’ confidence in the company. But still, we’ll cover all you need to know.

Crypto Vesting Schedule

The token vesting period, commonly referred to as the token lockup period, is a time frame during which tokens sold at the pre-ICO stage and handed to partners and project team members as rewards for their efforts cannot be traded. The project contains a vesting plan, commonly known as a token vesting contract, to release tokens over a particular time span.

Vesting on its own refers to entrusting an asset to a third party using a token vesting contract. Vested tokens are generally owned by project team members, partners, and consultants. They may also be owned by investors who purchased tokens prior to their general sale, as well as anyone who contributed to the project’s development.

These tokens usually get released over a defined time period, which is typically years as specified in a token vesting contract.

Types of Vesting

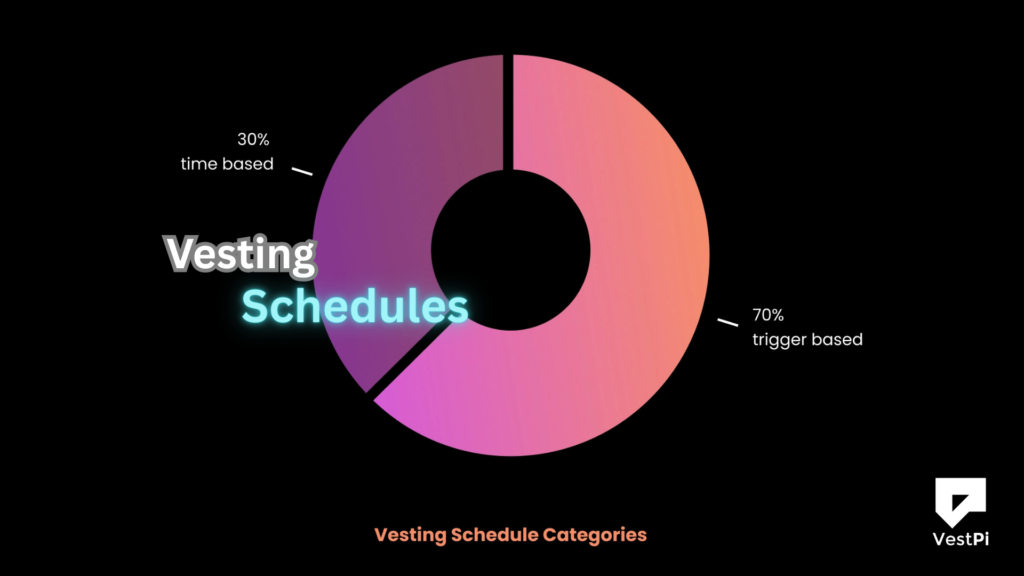

The goal of the vested tokens is to tie its distribution plan and, in particular, its tenure to play an important role. The word “Cliff,” which refers to a periodic lock imposed on tokens prior to the token vesting period, is the most commonly used one in the context of vesting. Its main customers are investors in seed money and private sales. The types of vesting are as follows, since the phrase is now clear:

- Linear vesting is the delivery of tokens in equal and specified chunks over a set period of time. The duration could range from a few hours to several years.

- Twisted vesting is a random distribution of tokens over time. The duration of time can be measured in days, weeks, months, or even years.

- Milestone vesting allows for conditional distribution of stock options and other equity incentives upon meeting specific targets. Milestone-based vesting is not limited to workers; consultants, advisors, and other types of personnel can also benefit from it.

Slavic 401 K Vesting Schedule for Stock Options

In addition to retirement plans, some firms include stock options as part of your pay. Vesting also has a part here, but with a twist. Stock options allow you to purchase company stock at a predetermined price, with the intention that the stock’s market value will climb above this price, resulting in a tidy profit.

Here’s how vesting schedules usually work:

- Cliff Period: A period of no release (for example, one year) prior to the vesting of any tokens. A long cliff frequently indicates a larger release at the end, which may cause a dip as those tokens unlock.

- Vesting Rate: How frequently tokens are distributed (monthly, quarterly). Faster rates indicate faster supply growth.

- Lock-up vs. Vesting: Lock-ups often release everything at once after the term, whereas vesting releases gradually.

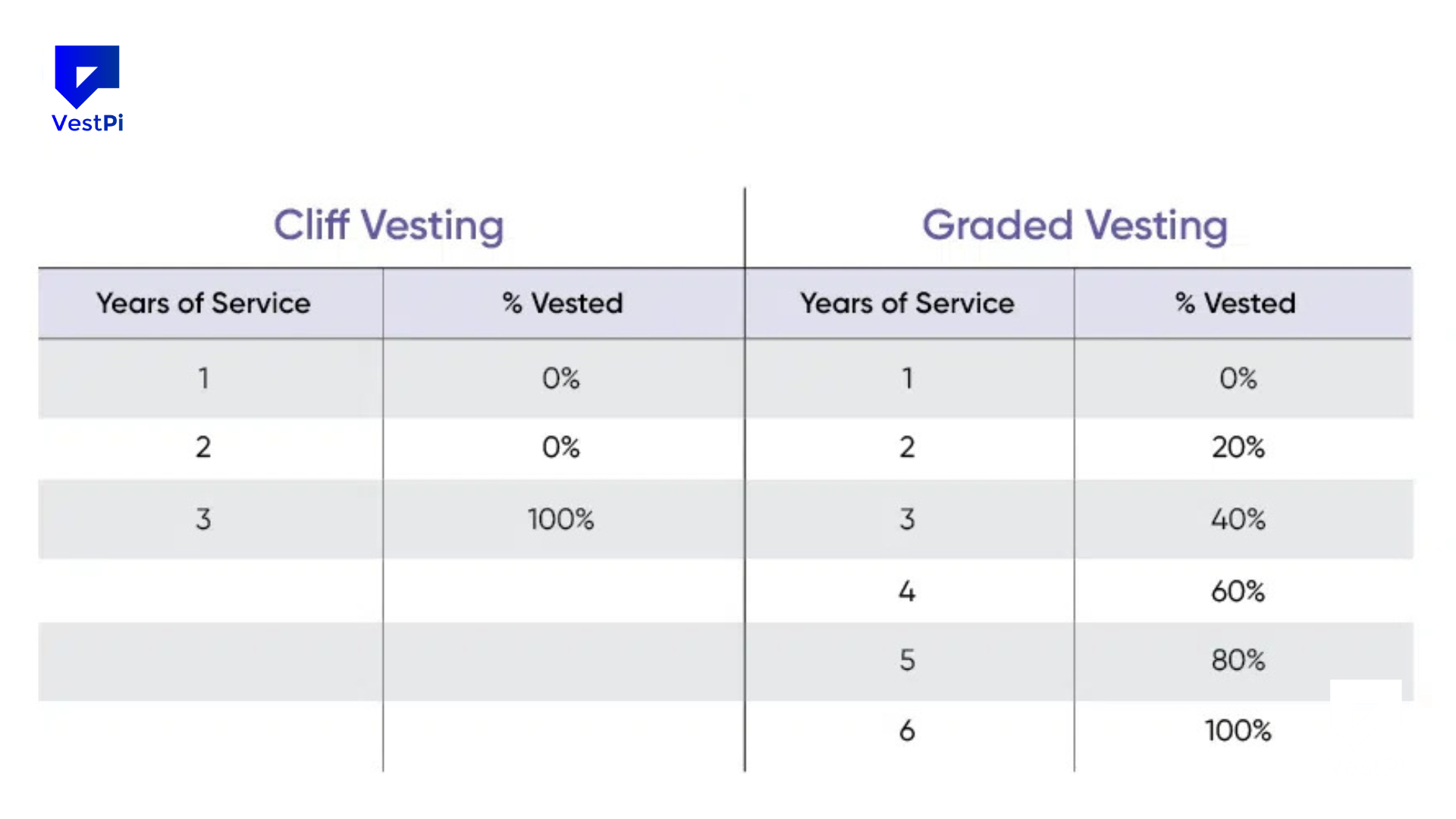

During cliff vesting, employees have access to all stock options at the same time, but they cannot utilize any of them to acquire shares until they achieve a predetermined employment duration, such as three or five years.

Meanwhile, graded vesting for stocks permits employees to exercise some of their stock options. A graded schedule allows employees to purchase a lower percentage of shares each year until they reach 100% eligibility at a predetermined employment date, such as five years.

401(k) Vesting is a method of protecting a company’s assets, and as an employee, you should be aware of which policy your business has. Understanding how vesting affects your retirement plan is essential for smart financial planning.

The vesting schedule can influence how long you work for the company, how much you contribute to your retirement account, and other factors. If you are unsure, contact your company’s human resources or benefits team for further information on your plan. After all, information is power, particularly in terms of your financial future.

How Vesting Schedules Affect Token Price

- Reduces Supply Shocks: Rather than releasing all tokens at once (producing a crash), vesting spreads them out, resulting in a continuous supply rise that is consistent with project growth.

- Incentivizes Commitment: Gradual release (e.g., over 1-4 years) encourages teams/investors to stay committed, expressing long-term vision while decreasing short-term profit taking.

- Manages Volatility: Vesting manages volatility by restricting the circulating supply, stabilizing prices, increasing investor confidence, and discouraging speculative dumping, so supporting long-term growth.

- Builds Trust: Transparent vesting timelines demonstrate a project’s commitment to long-term success, which improves reputation and attracts genuine participants.

Why Is Token Vesting Important?

The cryptocurrency market stands out due to its extraordinary volatility. During an Initial Coin Offering (ICO) or Initial DEX Offering (IDO), prices often skyrocket due to hype around new ventures, leading to significant sell-offs.

During an ICO or IDO, tokens are distributed through a decentralized liquidity marketplace or crowdfunding period, with project owners or early investors selling them as soon as they become accessible on the market. As a result, the token will have a large surplus supply, potentially leading to dramatic price drops.

As a result, token vesting is critical to the overall structure, as without token vesting and a token vesting contract, a single or a small group of people or organizations can control a significant amount of the project’s tokens beginning with the token generation event.

This provides them the power to instantly generate supply changes, thereby undermining the token’s ecosystem and price. This would put the token’s stability at considerable danger. To take it a step further, a vesting gives an employee a stake in the company’s success as well as a financial incentive to stay (while the vesting period lasts).

Vesting is frequently used in token allocation to avoid a sharp decline in price caused by everyone selling their tokens at once.

The corporation would be in a challenging situation if an employee waited out the vesting time, cashed out their tokens, and then began seeking a new position. The required vesting period has undoubtedly had the intended result.

This has incentivized the employee to stay with the company for a predetermined amount of time and prevented the tokens from being traded right away.

Why Vesting for VCs and Capitals Is Important?

Projects may face intense selling pressure following the IDO and after the token has been listed on Centralized Exchange (CEX) or Decentralized Exchange (DEX) due to the relatively large volumes sold during early-stage rounds.

By raising the total number of tokens in circulation, it dramatically reduces the price of tokens. Since blockchain technology is still in its infancy, it will take some time to grow and offer something.

IDO-funded initiatives usually work hard to draw audiences in order to fulfill use cases and eventually create intrinsic token value. It therefore requires patience, which Vesting is excellent at. After an exchange listing, there is no longer any worry about ceding token ownership to a small number of VCs or capitalists.

If this happens, a group of investors with more shares could manipulate the token price anyway they see fit, ruining the project’s ecosystem. Vesting has therefore developed into a key element of token economies that affects the investing decisions of all kinds of investors.

Why Do You Need a Token Lockup?

The majority of tokens must be retained by investors rather than being sold on the market in order for the token economy to be viable and efficient. By locking up tokens, members can prevent their token’s value from declining. It also protects holders’ interests by preventing team members from selling their tokens as soon as trade starts.

By locking up tokens, projects prevent dumpers from destroying the price as soon as the new token is listed on any exchange. Increasing investor interest by boosting their trust in the project’s long-term viability is a common component of their anti-dump campaign.

Since early investors must hang onto their assets for a predetermined period of time before selling them, token holders are protected from significant price fluctuations. Token lockup provides time for the development and release of a product if there isn’t yet a prototype.

Investors can evaluate the project’s progress throughout this period and decide whether to retain their tokens or swap tokens for Bitcoin or Ether.

Summary

In a nutshell, vesting schedules are an essential component of the cryptocurrency ecosystem, acting as a key tool for regulating token distribution and harmonizing stakeholder interests. Look out for tools that simplify vesting processes and ensure security, compliance, and transparency; they will be helpful.

Whether you’re creating a new coin or overseeing a large-scale distribution, such tools give you the support you need to streamline operations and build confidence among stakeholders.