The crypto market cycle is infamous for its erratic swings between fear and exhilaration. Investors who want to manage the highs and lows of this ever-changing industry must comprehend the cycles of the cryptocurrency market.

In this article, we’ll look at the structure of market cycles, current trends, and provide actionable advice for both newbies and seasoned crypto holders.

What Are Crypto Market Cycles?

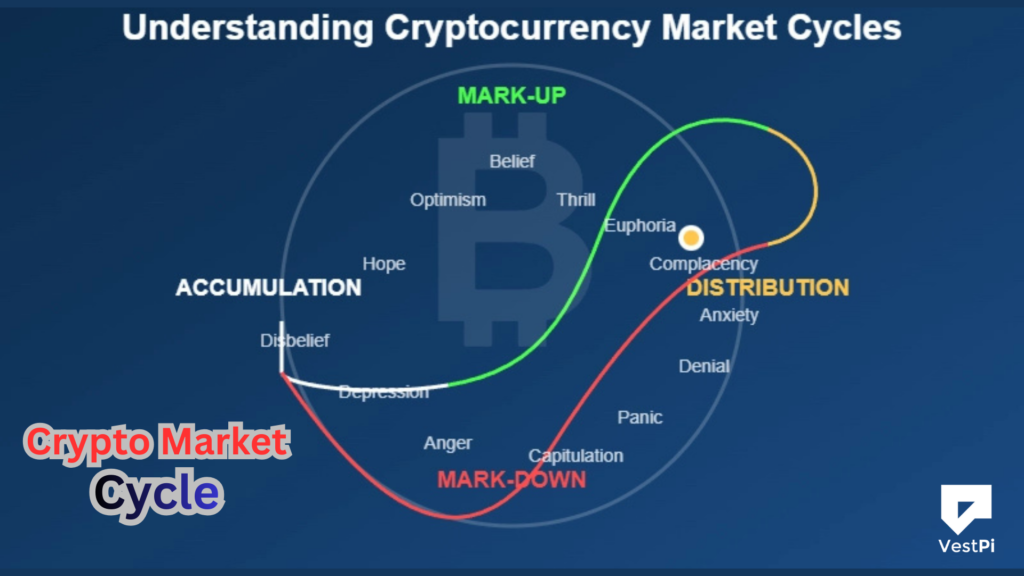

Crypto market cycles refer to recurring patterns of price movement, sentiment, and trading activity in the digital asset field. Unlike traditional markets, these cycles are frequently compressed, resulting in fast booms and crashes that elicit both excitement and caution.

Market cycles are often divided into several phases, each with its own set of features. Recognizing these stages can help investors minimize risk and seize opportunities.

The Four Phases of a Typical Crypto Market Cycle

The majority of analysts concur that the cryptocurrency market typically goes through four major phases, even though each market participant experiences these cycles differently:

- Accumulation Phase: This era follows a significant market downturn. Prices remain generally low and constant, with limited trading volumes. Despite pessimistic sentiment, intelligent investors are quietly accumulating assets for long-term growth. Early signs of recovery may emerge, but skepticism prevails. Accumulation is frequently the ideal risk-reward entry point for long-term investors.

- Growth Phase: As confidence returns, prices rise because of new technology, narratives, or macro events like Bitcoin halving cycles. This period is characterized by continuous purchasing interest, increased trade volumes, and a gradual transition from negative to positive sentiment. Growth frequently accelerates when additional people re-enter the market, pushing prices to approach or exceed earlier highs. Find out more about these phases in the Fidelity Digital Assets study.

- Bubble (Euphoria) Phase: During the bubble (euphoria) phase, price movements become exaggerated due to heightened optimism. FOMO (fear of missing out) dominates, resulting in quick, unsustainable gains. Media coverage grows, garnering both mainstream attention and speculative finance. This period is distinguished by intense greed, huge leverage, and frequently historically high valuations. However, danger is at its peak, as corrections can be rapid and harsh. For more information, refer to Caleb and Brown’s cycle explanation.

- Crash (Correction) Phase: After the bubble bursts, a sharp market correction occurs, wiping off a large amount of recent profits. Panic selling and negative attitudes prevail. Crypto bear markets typically have 70-80% declines from cycle highs. This unpleasant phase finally gives place to stability and the start of another accumulating period.

How to Find Crypto Market Phases

Now that you know how to spot conventional market cycles, you may be asking where you can obtain instruments to observe them for yourself.

In other words, where can you get data on crypto trading activity, price action, and mood so you may conduct your own analysis?

1. On-Chain Market Data

There are numerous internet resources that provide historical data on various elements of cryptocurrency. On-chain data services such as Glassnode, CoinMetrics, CoinMarketCap, and CoinGecko provide historical market and price activity.

You can track the market movement of currencies and tokens using on-chain data, as well as monitor the broader market activity.

2. Sentiment Monitoring

The Fear and Greed index is a widely used metric for assessing sentiment in the Bitcoin market. Extreme fear is represented by a score of 0 on the index, whereas extreme greed is represented by a score of 100. It is computed using a number of variables, such as social media engagement, market momentum, and volatility.

Identify trends for yourself if you want to gain a competitive advantage. These tools can be a useful resource if you want to learn more about the environment.

The Bitcoin Halving Cycle and Its Impact

The halving event, which occurs when the incentive for mining new blocks is halved, is a distinctive aspect of the cryptocurrency market, particularly for Bitcoin. This event has historically served as a potent motivator for market cycles and happens around every four years.

With each half, fewer new bitcoins are issued, increasing scarcity and frequently igniting fresh bull markets as supply becomes more constrained.

Practical Strategies for Navigating Crypto Market Cycles

- Stay informed: Monitor on-chain analytics, market mood indicators, and regulatory news to stay ahead of key moves. Glassnode and Messari provide valuable data.

- Diversify Wisely: Diversify wisely to prevent overexposure to a single asset or sector. Maintain a balanced portfolio that includes both established coins and promising novelties.

- Prioritize Security: In times of euphoria and terror, security is sometimes forgotten. Using a trusted hardware wallet like OneKey protects your assets from hackers, phishing, and exchange failures, providing peace of mind throughout the cycle.

- Manage Emotions: Recognize psychological traps linked with market extremes, such as greed and terror, and stick to a disciplined investment plan.

Our Takeaway

In a nutshell, it takes perseverance, self-control, and a dedication to lifelong learning to master cryptocurrency market cycles. The basic dynamics are very consistent, even though the people and stories may change.

Even while there is no foolproof method to forecast the future, understanding how cryptocurrency market cycles operate can help us comprehend both the larger picture and the game itself. As a result, we may be better equipped to manage our own cryptocurrency portfolio.

Therefore, as you traverse Web3 and cryptocurrency, be aware of your resources, make education your primary investment, and maintain your security.

In this fascinating environment, you are the master of your own experience because knowledge is power. It’s crucial to learn more about the Bear vs. Bull markets in order to comprehend the cryptocurrency market.