Crypto mining is still profitable, but it may not be as rewarding for individuals as in previous years. This is true for several reasons. Cryptocurrencies, in general, still have value, but assessing the potential for miner profitability can be more difficult than before, given the high cost of computer hardware and software required today, as well as the rising cost of electricity required to keep mining equipment operational. Crypto miners must deal with both rising competition and perhaps reduced earnings.

However, understanding the factors and expenses involved might help you decide whether cryptocurrency mining is a suitable fit for you. Before evaluating whether mining Bitcoin, Litecoin, Ethereum Classic, or other cryptocurrencies is worthwhile, you should understand how it works, alongside other relevant information.

Crypto mining is still a very active aspect of the entire cryptocurrency ecosystem. However, considering how popular bitcoin and blockchain technology have become in recent years, the competition has increased, and the rewards for mining specific coins have decreased. Let’s dive in to it!

What Is Crypto Mining?

Crypto mining is the process by which various blockchain networks validate and safeguard transactions or data while also earning rewards and new cryptocurrencies for miners, or network participants. As such, it both validates and expands the network.

Crypto mining involves more than merely creating new coins, such as Bitcoin (BTC), which uses a proof-of-work system. It’s also a decentralized worldwide system in which miners validate and safeguard bitcoin transactions while earning coins themselves. However, there are numerous alternatives, including Litecoin, Ethereum Classic, Dogecoin, and others.

It all comes back to blockchain technology, which is the foundation of cryptocurrencies. To operate these networks, miners use powerful computer systems, or in some cases cloud-based technologies, to solve challenging mathematical riddles and validate blocks of digital transactions.

This system is referred to as proof-of-work (PoW). Every transaction in a PoW system is recorded in the blockchain, which is a visible, immutable public ledger. Miners that solve it are rewarded with new currencies being produced.

Overall, mining serves the function of certifying a crypto network and providing rewards to network participants, often known as validators or miners. However, issues such as power usage, graphics cards, and operating costs can have a substantial impact on profitability, especially for home miners.

The two main consensus methods in mining are:

Proof of Work(PoW)

Used by Bitcoin and other cryptocurrencies, including Litecoin and Ethereum Classic. To function properly, this approach demands significant processing capacity and great power consumption. It also requires specialist graphics cards, which increases operational costs. All of these variables contribute to higher operational expenses throughout the process.

Proof of Stake (POS)

An energy-efficient alternative in which users stake their coins to validate blocks (such as Cardano or Ethereum 2.0). PoS dramatically reduces power usage, making it a more attractive solution for users concerned about cost and sustainability.

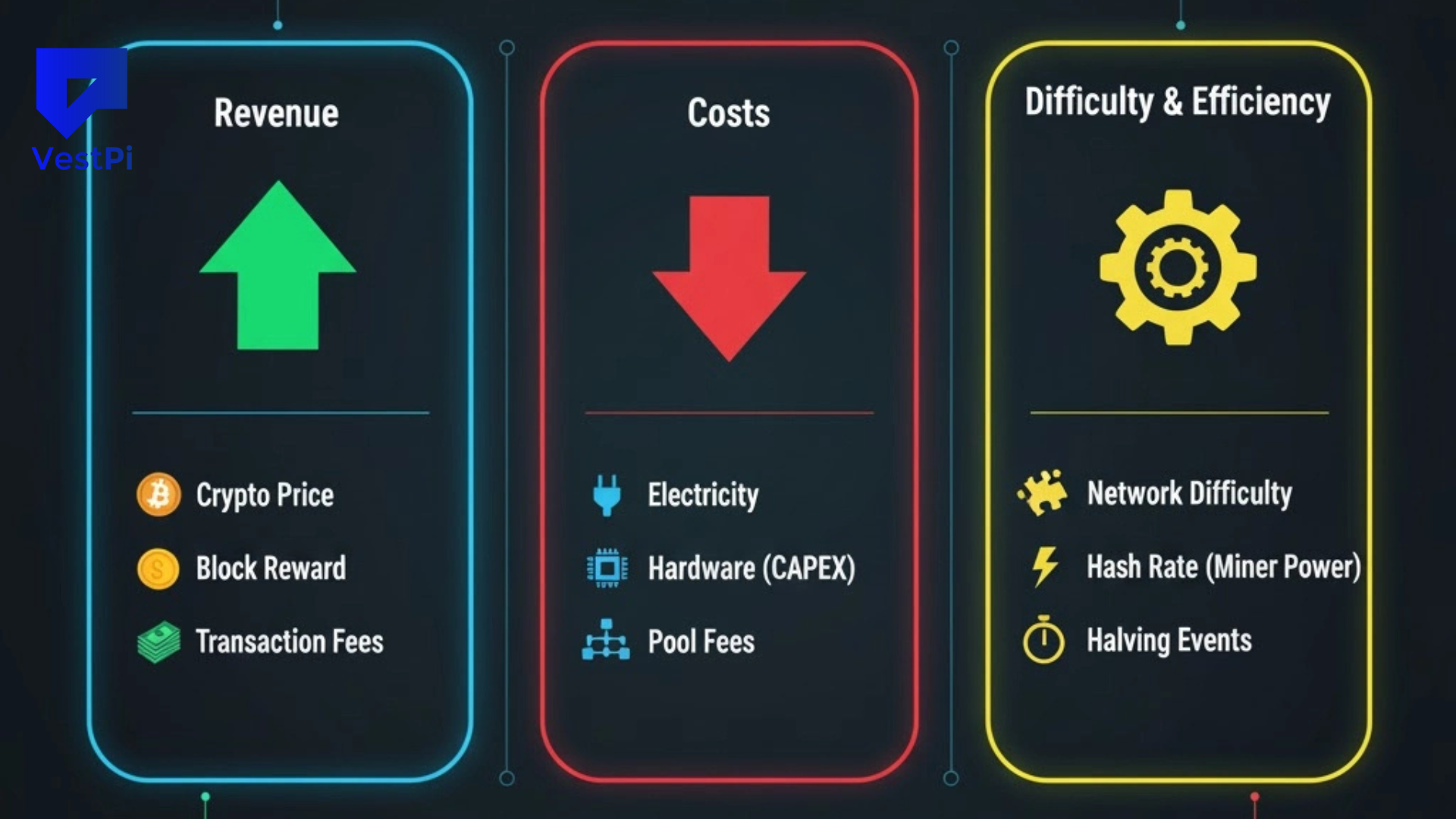

Factors Influencing the Profitability of Crypto Mining

1. Coin Volatility

Price volatility is one of the most important factors influencing profitability in mining. A dramatic price increase can quickly turn even losing operations profitable. However, a collapse might wipe away revenues or render mining unsustainable.

Kaspa (KAS) miners running at 9.2 TH/s reported daily income of up to $69 in January 2024. These bonanzas frequently cause gold-rush-like spikes of activity on the network, reducing profits for latecomers.

2. Electricity Costs

The highest recurring cost of mining is energy usage. Miners having access to cheap electricity, such as those in Paraguay, Iran, and areas of the United States, can stay lucrative even during a bad market. However, in expensive countries, mining is difficult without government subsidies or renewable energy. It costs about $1,324 to mine one Bitcoin in Iran, but more than $20,000 in Western Europe.

3. Hardware Efficiency

The mining market is dominated by power-efficient ASICs such as the WhatsMiner M60 series and Antminer S21. Such technology offers more hashes per watt, decreasing operating costs and increasing profitability. Equipment becomes obsolete quickly. Miners must also consider infrastructure such as cooling facilities and adequate living conditions, which affect hardware longevity and availability.

4. Network Difficulty

Mining becomes increasingly difficult as more miners join the blockchain network. This automatically regulated difficulty ensures that blocks are produced at a steady pace while offering low incentives per miner. Smaller or single operation operators favor coins with lower difficulty levels and hash rates, such as Ethereum Classic and Monero.

5. Regulation

National policies on mining vary:

- The United States, under new leadership, is supporting mining with tax breaks and energy subsidies.

- To address energy shortages, Russia banned cryptocurrency mining in ten locations until 2031.

- The European Union promotes greener standards and emissions reporting through MiCA and other programs.

These kind of changes have an impact on where miners operate and how they structure their activities.

Future Trends that Will Shape Mining

Cryptocurrency mining is evolving at rapid speed. As the year offers new problems, from rising costs to global laws, it also delivers technological innovation, cleaner methods, and new opportunities.

1. Green Mining and Clean Energy

Modern mining is distinguished by its focus on sustainability. Over 50% of global mining activities now rely on renewable energy sources such as solar, wind, and hydroelectric power. This not only saves money, but it also minimizes the environmental imprint, which is becoming increasingly important to regulators and the general public.

Energy-efficient operations in areas such as:

- Iceland is fuelled by geothermal energy.

- Texas offers wind-power subsidies.

- Paraguay has hydroelectric dams.

- are transforming into mining hubs.

2. Deployment of AI and Diversification of Data Centers

With mining profit margins falling, several companies are diversifying by converting mining infrastructure into AI and cloud computing platforms. Mining ASICs and high-end GPUs can be used for AI computations, providing a secondary source of income while eliminating reliance on currency payouts.

3. Advancements in Mining Hardware

Hardware innovation continues at a breakneck pace. Companies such as Bitmain, MicroBT, and Nvidia launch miners and GPUs with:

- More hashpower

- Less power consumption.

- Improved cooling solutions

- Smaller design for scalability.

This allows even smaller producers to keep up, provided they reinvest appropriately.

4. Quantum Computing on the Horizon

Quantum computing is poised to disrupt encryption and blockchain consensus systems, despite its early stages of development. Initiatives such as Google’s Willow chip anticipate the evolution of mining algorithms to support quantum proofing. Entrepreneurial miners are already keeping a lookout.

5. Regulation and Institutional Adoption

Regulations are evolving rapidly. While some governments (like as Russia) prohibit mining due to environmental and energy concerns, others (such as the United States) are becoming more crypto-friendly, offering tax breaks and encouraging business development. The EU’s Markets in Crypto-Assets (MiCA) regime is also developing more precise compliance standards for mining activities.

Most Profitable Cryptocurrencies to Mine in 2025

Aside from Bitcoin, several cryptocurrencies are easier to mine and provide higher profits for miners without institutional resources. These currencies are mined using various algorithms, which cover a wide range of hardware and application cases.

Bitcoin (BTC)

Algorithm: SHA-256 | Consensus: PoW

Best suited for: ASIC miners

Profitability Tip: Only profitable with high-efficiency ASICs and low energy costs. Join Bitcoin mining pools to receive consistent payments. Always be mindful of the risks, particularly the possibility of a 51-attack on smaller networks.

Ethereum Classic (ETC)

Algorithm: Etchash | Consensus: PoW

Benefit: Still mineable with GPUs; ASIC resistant to some extent

Energy Profile: Moderate

Use Case: Smart contracts with a safe, immutable chain powered by blockchain technology.

Monero (XMR)

Algorithm: RandomX | Consensus: PoW

Benefit: Prioritizes privacy; ASIC resistant

Hardware: CPU and GPU-friendly

Why it’s profitable: Lower hardware costs have made XMR popular among DIY miners wanting freedom from centralized authority. Anonymous transactions also appeal to miners who value privacy and control over their operations.

Dash (DASH)

Algorithm: X11 | Consensus: PoW

Feature: Masternode rewards and fast transactions

Why mine: It is well-known for its hybrid model and community support among a diverse network of individuals.

Chia (XCH)

Algorithm: Proof of Space and Time

Unique Angle: Uses hard drive space rather than processing power

Eco-benefit: Lower energy consumption assists green crypto miners who wish to reduce their high electricity expenses. It also helps to lower computing demands while promoting energy-efficient mining operations.

Is Crypto Mining Still Worth It?

Crypto mining remains a profitable possibility, but it is no longer as straightforward as it once was. The environment has evolved into a competitive, capital-intensive world of global energy pricing, hardware innovation, and regulatory instability.

Initially, CPUs could mine Bitcoin. Then GPUs became the standard, followed by ASICs (Application-Specific Integrated Circuits), which today control the Bitcoin network. To be lucrative in today’s cryptocurrency world, you need greater power, innovative tactics, and, in some cases, cloud mining platforms.

The payoff for wise, strategic, and effective miners remains extremely concrete. Players who can obtain low-cost electricity, invest in appropriate hardware, and remain ahead of technological and market developments might secure a profitable niche position in the mining industry.

Success is no longer achieved by simply plugging something in; rather, it is achieved by making clever, flexible judgments in the context of an ever-changing environment. Crypto mining remains profitable, but only for those ready to view it as a real, expanding enterprise.

How to Calculate Mining Profitability?

To evaluate if mining is viable, miners must consider numerous aspects, including hardware efficiency, electricity costs, and the current bitcoin price. This can be done manually or with mining profitability calculators.

This is when things become interesting. Several online tools allow miners to estimate their prospective earnings by inputting their hardware’s hash rate, power usage, and local electricity costs. These calculators provide a detailed breakdown, taking into account difficulty, block reward, and pool fees.

For example, a mining profitability calculator can help you assess whether your setup will earn enough revenue to cover operational costs like hardware maintenance and electricity.

What Are the Best Mining Hardware Options?

The type of mining hardware you utilize is critical to increasing your profitability. ASIC miners, while pricey, provide unparalleled performance and efficiency for Bitcoin mining. GPU rigs, on the other hand, are more adaptable and may be used to mine a wide range of Alt coins.

ASIC miners are necessary for high-stakes Bitcoin mining, whereas GPU rigs may suffice for altcoins.

Here’s a brief overview of the finest mining hardware in 2025:

| Hardware Type | Best For | Price Range (USD) | Efficiency (Hash Rate) | Power Consumption (Watts) |

|---|---|---|---|---|

| ASIC Miner | Bitcoin mining | $2,500–$12,000 | 80–120 TH/s | 2000W–3500W |

| GPU Rig | Altcoin mining (Ethereum, Monero) | $1,000–$5,000 | 60–300 MH/s | 600W–1500W |

Can You Mine Crypto at Home?

With the correct equipment, it is possible to mine cryptocurrency from home. However, as the mining industry gets more competitive, home mining has become less economical unless you have access to low-cost electricity and efficient equipment.

But here’s the kicker. Space, cooling requirements, and the high energy expenses associated with running mining equipment are all common barriers to home mining success.

Cloud mining services provide an alternative for people who cannot afford to invest in pricey gear. Cloud mining involves renting hash power from a faraway data center and sharing the rewards. However, cloud mining carries its own set of risks, including fraud and low earning margins.

Wrapping Up

In a phrase, cryptocurrency mining remains profitable in 2025, but it is not as straightforward as it previously was. Individuals must approach the market strategically, given the increasing difficulty levels, rising energy usage, and competition from institutional miners.

To improve their operations, smart crypto miners diversify their portfolios, use cloud mining platforms, keep track of transaction fees, and prioritize hardware efficiency. Investigate ASIC-resistant coins such as Monero (XMR) or other environmentally friendly alternatives. Crypto mining remains a viable source of income for those who undertake extensive research, manage risks well, and adapt rapidly.