Understanding how to track whale wallets is crucial for discovering possible opportunities or hazards, recognizing patterns, and market movements.

Following wallet activity can provide important insights, such as whale movements, insider trading patterns, or fraudulent activity, whether you are an analyst, trader, or investor. You can keep an eye on transactions in real time and obtain a competitive advantage in the cryptocurrency market by utilizing blockchain analysis tools like Dexscreener and Arkham Intelligence.

Information thrives in the movement of cryptocurrency markets, and monitoring the capital deployment patterns of major holders offers a crucial advantage. A crypto whale tracker provides market movement data not found in traditional finance by revealing institutional positioning through blockchain transparency.

These trades convey conviction from sophisticated market movers when whales congregate during fear or disperse close to peaks. In volatile digital asset markets, knowing whale behavior distinguishes knowledgeable traders from reactive players.

What Are Crypto Whales and Why They Matter

Crypto whales are organizations that possess significant quantities of cryptocurrency, usually in the range of $1 million to $1 billion or more. Institutional investors, early adopters of Ethereum and Bitcoin, cryptocurrency exchanges, project founders, and sophisticated trading funds are some of these major holders.

Due to concentration, a small number of wallets own disproportionate shares of the whole bitcoin supply, which gives them market power.

When whales shift positions, this concentration has a disproportionate effect on prices. Market values can be significantly changed by a single whale transaction, especially for less liquid cryptocurrencies.

Potential selling pressure is indicated when a wallet with 5,000 Bitcoin transfers to an exchange; this information causes markets to move prior to execution. On the other hand, multiple whales’ consistent exchange outflows suggest a buildup.

Transparent monitoring is made possible by blockchain technology, which makes transaction data publicly available. Crypto whales use visible ledgers, in contrast to traditional finance, where institutional positioning is still hidden. Crypto whale tracking software provide access to every Bitcoin transfer, Ethereum wallet balance, and trading volume of major holders.

On their importance, whales have better resources, knowledge of the market, and information. Retail traders can obtain institutional positioning by keeping an eye on whale alert crypto signals, which turns trading from speculation into well-informed decision-making based on observable large holder behavior across digital assets.

The Market Impact of Whale Movements?

Through three processes, the movements of bitcoin whales cause market volatility by amplifying their enormous cryptocurrency holdings into disproportionate price implications.

Liquidity dynamics produce quick impacts. When a whale placed a 500 Bitcoin sell order on an exchange with 2,000 BTC daily volume, that represents 25% of average activity, resulting in extreme price slippage that might surpass $1,000 fluctuations.

Sell walls (huge sell orders at specified levels) provide an obvious barrier, blocking upward progress. Buy barriers work in the opposite direction, supporting prices while preventing them from falling. These walls shape market psychology as traders position themselves based on perceived support and resistance.

Sentiment influence works through cascading effects. When blockchain data shows whale wallets collecting Ethereum amid corrections, market players view it as institutional confidence, resulting in follow-on buying.

The psychology turns dramatically: observable whale distribution patterns indicate pessimistic mood, promoting preemptive selling. Sentiment contagion causes market moves to amplify beyond the extent of the originating transaction.

Technical trigger activation enhances the effect with methodical reactions. For example, a whale transaction that pushes Bitcoin past resistance at $75,000 or $110,000 could cause shorts to place stop-loss orders and breakout traders to place limit buys, resulting in a wave of algorithmic and retail buying pressure.

OTC trading enables whales to reduce market impact for large purchases by negotiating off-market trades at premiums to current pricing. Understanding these mechanisms explains why crypto whale tracker systems detect not only huge transactions but also potential market manipulation through coordinated behavior that distorts price discovery in the cryptocurrency market.

Famous Crypto Whales Worth Tracking

Not all whales provide equal trading intelligence; recognizing entity categories distinguishes important signals from noise.

The cold wallets of exchange-affiliated giants like Coinbase and Binance, which contain billions of Bitcoin and Ethereum, demand careful interpretation. Massive exchange inflows imply possible selling pressure, whereas protracted outflows indicate institutional accumulation.

Institutional holders, such as MicroStrategy’s Bitcoin treasury and Grayscale’s trust addresses, indicate corporate allocation adjustments at the institutional level and are high-value tracking targets.

Tracking top crypto holders using anonymous smart money wallets with profitable trading histories can reveal valuable information.

Tracking value varies greatly depending on the type. Identifying wallet ownership via crypto whale tracker services gives critical context—a $50 million Bitcoin transfer has dramatically different ramifications depending on whether it is the result of exchange rebalancing or institutional fund positioning.

Methodical Approach to Track Crypto Whales

A methodical approach based on three pillars is necessary for successful whale tracking.

- Data collection: Using the top crypto whale tracker tools throughout blockchain networks, data collection creates monitoring. Set thresholds for transaction alerts: Ethereum 1,000+ ETH, Bitcoin 100+ BTC, and altcoins adjusted proportionately.

- Pattern recognition: Movements are divided into four categories by pattern recognition: distribution (inflows), accumulation (exchange outflows), inter-wallet transfers, and rebalancing.

- Action framework: The action framework distinguishes between observation-only data and actionable intelligence.

Transparent whale watching crypto analysis is made possible by blockchain monitoring using publicly available data. When following cryptocurrency whales, systematic wallet analysis distinguishes between signals and noise.

On-Chain Analysis Techniques

Blockchain transactions are transformed into actionable whale information through on-chain analysis, which involves a systematic public ledger investigation of blockchain networks.

- Ethereum whale tracking through Etherscan tracks significant Ethereum transfers and ERC-20 token flow. Key variables include transaction frequency, average size, wallet age, and historical balance fluctuations. Wallet clustering identifies many addresses controlled by a single entity based on shared funding sources, timing patterns, and interaction linkages, showing true placement beyond surface wallet counts.

- Bitcoin analysis: Bitcoin analysis investigates UTXO patterns and coin ages. Dormant coins suddenly moving indicate long-term holder conviction adjustments. Wallet concentration measures indicate supply distribution, whereas exchange flow dynamics highlight accumulation versus distribution via net inflow/outflow tracking.

- Emerging chains: To accommodate varied transaction structures and market maturity, emerging chains like Solana Blockchain require tailored techniques and lower whale thresholds.

- Blockchain technology offers transparent monitoring, which was previously unachievable in traditional markets; institutional positioning is now available through public transaction data. However, blockchain explorers supply raw infrastructure; interpretation distinguishes signal from noise.

The Best Crypto Whale Tracking Tools

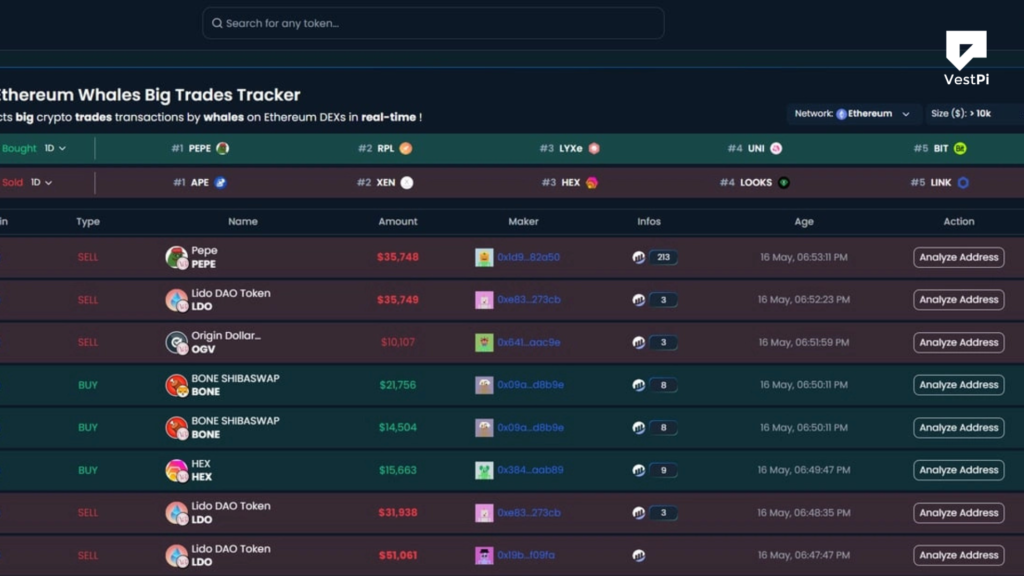

Effective whale tracking necessitates a multi-platform strategy, with many crypto whale tracker apps excelling at specific blockchain analytics features.

Whale Alert provides real-time alerts for transactions surpassing $500,000 across 10+ blockchains via Twitter/X, website, and API, making it ideal for tracking huge transactions.

Arkham Intelligence specializes in entity identification and relationship mapping. They provide wallet identification services that identify address controllers and institutional links, turning anonymous wallets into actionable intelligence.

Etherscan offers essential blockchain tracking tools, including raw transaction data, contract interactions, and historical analytics for Ethereum verification.

Cryptocurrency Alerting provides configurable wallet alerts with user-defined thresholds across several distribution platforms.

DeBank focuses on tracking DeFi whales and providing cross-chain portfolio visibility.

Why Track Crypto Wallets?

With tracking wallets, you can:

- Identify patterns early: Whale movements frequently anticipate price changes.

- Avoid frauds: Avoid fraud by identifying questionable transactions (such as rug pulls).

- Copy smart money: Learn from successful traders without blindly copying.

Step-by-Step Guide to Track Crypto Wallets

- Step 1: Visit dexscreener.com and choose a coin with exceptional performance. DexScreener is a free, no-login application that tracks 80+ blockchains and 5,000+ coins.

- Step 2: Navigate to the bottom of the screen and select “Top Traders”.

- Step 3: To obtain the trader’s wallet address, choose the wallet with a significant amount of money and tap the “EXP” icon on the far left.

- Step 4: Enter the wallet address to examine the trader’s portfolio, current holdings, token balance history, inflow/outflow, and on-chain actions.

Conclusion

To put it briefly, tracking cryptocurrency wallets is about more than simply making money; it’s about knowing the backstory of the transactions. With Arkham’s forensic capabilities and DexScreener’s real-time data, you can decipher the crypto markets like never before.