Uncover the differences between DEX vs CEX crypto exchanges. Centralized and decentralized exchanges offer different paths into crypto. This beginner-friendly guide breaks down the advantages, disadvantages, and the key differences for beginners.

The most basic way to participate in Web3 is to purchase or exchange cryptocurrency tokens. To do this, a user needs travel to a crypto exchange, which can be either centralised (CEX) or decentralised (DEX).

While both CEXs and DEXs facilitate cryptocurrency exchanges, their operations differ significantly. Before trading cryptocurrency, it’s important to understand the distinctions.

In this post, we’ll go over the key differences between CEXs and DEXs so you can make an informed decision about where to conduct your next crypto deal.

What Is a Centralized Exchange (CEX)?

Cryptocurrency exchanges known as central exchanges (CEXs) employ a centralized intermediary to supervise and facilitate cryptocurrency asset trading between users. Similar to conventional electronic stock exchanges, CEXs employ an order book mechanism to present and match buy and sell orders from users.

Many CEXs also function as crypto on-ramps and off-ramps, as they let users deposit fiat money into their accounts or convert their cryptocurrency holdings back into fiat.

What Is the Mechanism Behind CEXs?

The functionality of centralized exchanges resembles that of conventional online trading platforms. The exchange keeps your crypto or fiat in a custodial wallet after you open an account and make a deposit. The exchange’s internal matching engine uses an order book system to match buy and sell orders off-chain in order to carry out trades.

This system allows CEXs to handle thousands (or even millions) of transactions per second, giving users quick execution and a familiar interface. It also implies, however, that users must rely on the exchange to maintain its solvency, abide by rules, and protect their assets and private keys. You may need to be KYC verified before you can begin trading on centralized exchanges. This involves uploading data, such as a photo of your identity. your address verification, signature, and official government identification.

Instances of CEXs

Some prominent centralized exchanges are:

- Binance: Binance is the largest exchange in the world in terms of trading volume, with hundreds of coins and sophisticated trading choices.

- Coinbase: Coinbase is a well-known, publicly traded exchange in the United States that appeals to novice users because of its straightforward design and adherence to regulations.

- Kraken: Renowned for its security and variety of fiat currencies supported.

- Gemini: A New York-regulated exchange that specializes in institutional services.

What Does a Decentralized Exchange (DEX) Mean?

Crypto exchanges are decentralized exchanges that allow users to trade one cryptocurrency for another in a decentralized, non-custodial manner without the need for centralized middlemen. Additionally, DEXs are permissionless, meaning that anybody may use one without disclosing their personal data. A non-custodial crypto wallet is all that is required to access a DEX.

What Mechanisms Do DEXs Use?

Decentralized exchanges, in contrast to CEXs, do not need custodial wallets or user accounts. You engage with smart contracts directly on the blockchain by connecting your non-custodial wallet, such as MetaMask or Ledger.

DEXs initially used on-chain order books, but this meant that a trade order had to be recorded by every node of a blockchain before it could be executed. This slowed the procedure down to an intolerable degree, as one would expect. The answer? Decentralized exchanges with automated market makers (AMMs).

Automated Market Makers (AMMs)

The system of Automated Market Makers (AMMs) uses liquidity pools financed by users instead of order books. This is how it functions:

- Liquidity providers (LPs) contribute pairs of tokens, such as ETH/USDC, to a pool.

- From there, traders may trade one token for another straight from the pool.

- A mathematical formula (usually x * y = k) is used to set prices, which keeps the pool in equilibrium.

Although AMMs made decentralized trading more accessible and scalable, they also brought with them new risks for liquidity providers, such as transient loss.

Samples of DEXs

Among the well-known decentralized exchanges are:

- Uniswap: The most popular Ethereum-based DEX in terms of trading volume and TVL. As the pioneer of the AMM model, Uniswap provides significant liquidity for thousands of ERC-20 tokens.

- PancakeSwap: Built on Binance Smart Chain (BSC), PancakeSwap is well-known for its low costs and availability to a large selection of tokens.

- Curve Finance: Focuses on stablecoin swaps, providing low slippage and effective trading for assets that are tied to a peg.

- SushiSwap: This is a community-driven Uniswap fork that has yield farming capabilities and has grown to encompass several blockchains.

- dYdX: A decentralized platform that specializes in derivatives and provides sophisticated trading tools and perpetual contracts without the use of a central intermediary. The time series of DeFi TVL (Image source)

Advantages of Centralized Exchanges (CEX)

Centralized exchanges continue to be the preferred option for both novice and seasoned traders because of the numerous benefits they provide, which make trading quicker and more convenient:

High Liquidity

The great majority of crypto users choose to trade on CEXs rather than DEXs due to their UI similarity to Web2 platforms and their integration with conventional finance. CEXs gain from this increased trading volume and liquidity.

Easy Fiat-to-Crypto Exchanges

CEXs serve as both on-ramps and off-ramps, and users can effortlessly switch between fiat and cryptocurrency.

Quick Transactions

Because they use off-chain matching systems designed to handle a high volume of transactions, CEXs are able to execute transactions more quickly than their decentralized counterparts.

Increased User-Friendliness

Because the user interface of a CEX resembles that of conventional stock trading platforms, it may be simpler to use. Additionally, the exchange manages the transaction on the user’s behalf, which typically streamlines the process, particularly for newbies.

Additional Trading Capabilities

Users of central exchanges may also have access to a wider range of trading and investment opportunities, such as spot trading, options, futures, leverage, and more.

Disadvantages of CEXs

CEXs have significant drawbacks, which users should weigh carefully before depending on them for all of their trading activity, even if they are convenient.

No Privacy

To utilize a CEX, users must go through a required identity verification process, like KYC. Users must provide personal information, which some might see as a barrier to entry.

Lack of Control

When it comes to CEXs, the platform controls your private keys rather than you. CEXs have the ability to halt trading operations and restrict your access to your money.

Loss as A Result of Hacking

Users’ money is kept in wallets that are managed by a central authority at CEXs. Even with all security precautions in place, you could still lose your money if your wallet is hacked.

Benefits of Decentralized Exchanges (DEX)

Because of features that prioritize user control, privacy, and access to new tokens, decentralized exchanges are becoming increasingly popular.

You Own Custody

With DEXs, your money is always kept in your non-custodial wallet. Your money cannot be frozen or transactions stopped on DEXs.

Lower Risk of Security Breaches

Users’ funds are not at risk in the event of a DEX hack. This indicates that a DEX has a reduced overall risk in the event of a hack.

No Restrictions on Accounts

Because DEXs don’t need users to go through a KYC procedure, anybody may begin trading cryptocurrencies in a matter of seconds. Gaining access to uncommon tokens, new initiatives may list their tokens and establish liquidity pools with ease since DEXs are permissionless. Before projects are listed on a CEX, this gives users the opportunity to join them early.

The Downsides of DEXs

Although DEXs offer consumers greater flexibility, they also have obstacles that might make trading harder, particularly for beginners.

There Are Not Many Trading Options

Since DEXs lack the infrastructure to evaluate assets and implement various indicators, they are primarily restricted to facilitating simple token exchanges, which might be crucial to certain cryptocurrency trading.

The Transaction Speed Is Slower

Since transactions occur on-chain on a DEX, miners must confirm them before they can be included in the block. This is slower than exchanges like Binance, whose matching engine can handle over 1,400,000 transactions per second.

Reduced Liquidity and Trading Volumes

Despite the rising popularity of DEXs, it cannot be disputed that CEXs continue to hold the majority of trading volume. According to data from Dune and the Block, spot trading volume has consistently been handled by CEXs.

For example, in 2021, trading volumes on CEXs exceeded $14 trillion, while those on DEXs were just over $84.98 billion. But since the summer of 2020, DEXs have been making consistent progress. The biggest proportion of spot trade volume conducted through DEXs was recently recorded in june 2025, with little over 24% of the total, up from only 1% about five years ago.

Not User-Friendly

Since DEXs do not mimic the user interfaces of conventional stock trading platforms, they can be challenging for novices to comprehend and use. In order to conduct transactions and transfer money, DEXs also need users to link non-custodial wallets, which can seem complicated.

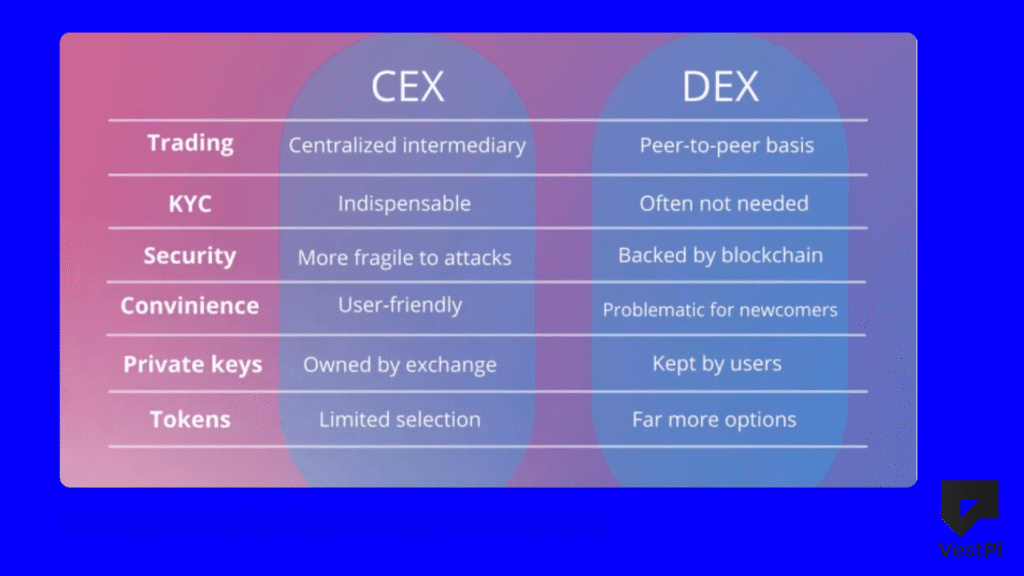

Major Differences Between CEX and DEX

Although you may trade cryptocurrency on both DEXs and CEXs, the methods are quite different. In terms of control, trust, and openness, the two models represent opposite ends of the spectrum, from how assets are kept to who has access.

- Custody: The platform manages your money and keeps your keys when you utilize a centralized exchange. You conduct transactions straight from your own wallet while maintaining control of your keys on a DEX. There is no middleman.

- KYC and Regulation: The purpose of a CEX is to adhere to financial laws. This entails submitting to identity verification and getting account clearance. DEXs are permissionless. They may be used by anybody with a wallet, and no identification is necessary.

- Security and Transparency: CEXs operate on a private infrastructure. You are not always aware of what is going on behind the scenes. The transactions and logic of DEXs, which are based on open smart contracts, are visible on-chain.

- Inclusion and Access: CEXs frequently impose restrictions on who may use them based on their financial history, paperwork, or location. Gatekeepers are not present in DEXs. You may trade if you have a wallet and access to the internet.

Summary

In a nutshell, DEXs value privacy, self-custody, and permissionless access, whereas CEXs give priority to convenience, liquidity, and sophisticated trading tools. The correct answer relies on whether you value ease of use and fiat access (CEX) or control and decentralization (DEX), since neither is intrinsically “better.”