DeFi staking is a full-fledged passive income endeavour driven by Defi Staking Platforms‘ smart contracts, killer APYs, and functionalities that operate while you sleep, not simply a simple case of parking your cryptocurrency and hoping for the best. We go beyond catchphrases in this guide and examine the top 10 DeFi staking platforms for 2025.

What is DeFi Staking?

DeFi staking is a generic term for a number of distinct yield paths that have a similar wallet appearance but vary significantly in terms of risk, liquidity, and return source. Accurate taxonomy aids in position sizing and prevents inconsistencies between exit mechanisms and time horizon.

How Does DeFi Staking Work?

By locking their native tokens inside smart contracts, DeFi crypto staking allows investors to fund blockchain operations. These tasks typically entail blockchain network security, transaction validation, and governance participation.

Both fungible and non-fungible tokens (NFTs) are available for investors to stake. The amount of tokens staked, the lock-in time, and the blockchain’s rules will all affect the total payouts. The annual percentage yield (APY) of the tokens will increase with the length of time they are locked.

Step-by-Step Process of DeFi Staking

- Select a Platform for Staking: Choose a DeFi staking platform according to your requirements.

- Create and Link a Cryptocurrency Wallet: Make a staking crypto wallet and connect it to the staking site of your choice.

- Acquire and Hold Tokens: Tokens you wish to stake should be purchased. Select a pool for staking. And type in how much you want to bet.

- Examine Staking Terms: Verify the terms of the platform, such as the reward schedule, lock-up time, and minimum staking amount.

- Verify the transaction: Give your approval and finish the staking transaction.

- Pay Attention to Your Staking: Use the platform to monitor your staking performance.

- Get Incentives: Await the delivery of rewards to your staking account or wallet at the conclusion of each epoch or following the lock-up period.

Staking with DeFi is easy: select a platform, create a wallet, stake your tokens, check terms, validate, track, and get rewards. To begin making money with DeFi staking, follow these steps.

Where to Stake DeFi Tokens?

Staking DeFi coins is an excellent method to put your funds to work while also promoting decentralised networks. That being said, Best Wallet is the most secure DeFi staking platform in 2025.

Finding the ideal DeFi platform for staking in 2025 is about more than simply high APYs; it’s about control, flexibility, and long-term value. This is why Best Wallet is at the top of our list. The wallet is entirely decentralised and non-custodial, with built-in staking and presale access, allowing users to earn rewards without compromising their keys or privacy. From beginners to DeFi strong users, Best Wallet establishes the gold standard for staking.

Key Features

- Supported cryptocurrencies: several tokens across 60+ blockchains.

- APY: Up to 165% (varies depending on token and staking program)

- Minimum Staking Amount: Depends on the token, usually minimal or none.

- Reward distribution is real-time or per block, depending on the network.

- Lock-up period varies by token and staking pool.

- The key features include DEX aggregation, presale access, and multi-chain staking.

- Non-custodial wallet with complete control of private keys.

Best Wallet is a multipurpose Web3 wallet that simplifies and secures staking and DeFi. With compatibility for more than 60 blockchains, you can manage, swap, and stake tokens without switching between platforms. The staking page allows you to investigate active staking opportunities directly within the wallet, eliminating the need to rely on dubious third-party services. Essentially, this wallet is a zero-fee DeFi platform.

Defi Staking Platforms with Moderate Risk

Aside from Best Wallet, we have selected ten different DeFi staking platforms based on the following criteria: supported cryptocurrencies, APYs, reward distribution and frequency, staking terms (such as lock-up periods and minimum staking amounts), and withdrawal options. Here’s a thorough overview of the Top 10 Defi staking platforms.

1. CoinDepo: Crypto and Stablecoin Staking

Key Features

- Supported cryptocurrencies include ETH, BTC, SOL, and many others.

- APY: up to 24 percent

- Minimum Staking Amount: There is no required minimum

- Reward Distribution: different distributions, from daily to annual.

- Lock-up Period: Flexible Periods

- The key advantages include zero commissions, guaranteed accounts, and no minimum deposit requirements.

- COINDEPO token holders unlock higher yields.

CoinDepo is a popular DeFi alternative for staking idle cryptocurrencies and stablecoins to generate passive revenue. Since 2021, the platform has merged Fireblocks’ high security with the skills of a team familiar with both blockchain technology and traditional finance. This combination allowed the team to create a service with one of the highest staking APYs (or APRs) of up to 24%.

Users may deposit popular cryptocurrencies like as BTC, ETH, and SOL, as well as stablecoins, into Compound Interest Accounts and earn between 12% and 24% per year. The biggest yields are associated with distributions over longer time periods; however, consumers can also choose to receive daily payouts for lower rates.

2. Lido: Ethereum Liquid Staking

Key Features

- Supported cryptocurrency: ETH

- APY: 2.82%

- Minimum Staking Amount: There is no required minimum

- Reward distribution occurs within 24 hours of making a deposit.

- Lock-up Period: No lock-up period, no minimum requirements.

- Key features include DVT, curated, and permissionless modules.

- Simple on-chain delegation.

Lido is a DeFi platform that focuses on liquid staking. Users can stake ETH on several networks while retaining liquidity. Lido users could previously stake Polygon, but this option was abolished on December 16, 2024. Lido converts staked ETH tokens to stETH, which may be utilised like ordinary ETH.

They can be exchanged on secondary marketplaces, used as collateral in restaking, and lent and borrowed through DeFi protocols. Lido offers no minimum criteria or lock-up periods, making it ideal for novices.

3. Aave: Lending and Borrowing

Key Features

- Supported cryptocurrencies: GHO, AAVE, and ABPT

- APY is 6.89% for GHO, 4.55% for AAVE, and 19.58% for ABPT.

- Minimum Staking Amount: There is no required minimum

- Reward distribution occurs once users withdraw or transfer AAVE from the Safety Module.

- Lock-up Period: Determined by procedures.

- Key features include rewards through lending, borrowing, and staking options.

- Flash Loans allow investors to borrow assets without collateral.

- Liquid eModes make the borrowing and lending process more affordable and flexible.

Aave is a liquidity protocol that allows users to receive rewards for being suppliers or borrowers. Aave is also an OG DeFi platform, which is one of the most well-known and recognised in the crypto space. Suppliers earn interest by locking their tokens into liquidity pools, while borrowers protect the network with collateral bigger than the loan amount.

Suppliers share the interest paid by borrowers and receive a piece of the Flash Loan fees. Aave’s Flash Loans lets investors borrow an asset without providing collateral.

4. Curve: Stablecoin Trading

Key Features

- Supported cryptocurrencies: stablecoins.

- APY is based on trading activities.

- Minimum Staking Amount: There is no required minimum

- Reward Distribution: Fees are collected every week from the pools and converted into crvUSD

- Lock-up Period: one week to four years, making it flexible.

- The locking mechanism allows customers to increase their benefits up to 2.5 times.

- 370+ liquidity pools.

Curve is a decentralised exchange focused on stablecoin trading and lending. This DEX operates on the basis of liquidity pools. Its users will have access to over 370 liquidity pools where they may stake their stablecoins and earn incentives. Curve also employs AMM methods to improve stablecoin transactions and reduce slippage and hefty fees.

Curve is powered by CRV coins, which are used to compensate liquidity providers. When someone trades on Curve, liquidity providers receive 50% of the trading charge (converted into crvUSD). The CRV token can be staked and used to vote.

5. Yearn: Yield Farming

Key Features

- Supported cryptocurrencies: stablecoins.

- APY: Depends on the vault.

- The minimum staking amount depends on the vault.

- Reward Distribution: Every week.

- Lock-up period: one week to four years.

- The key aspects include automated yield farming strategies.

- User-managed liquidity pools

- Decentralised and community-driven government paradigm.

Yearn is a DeFi yield aggregator that allows customers to earn rewards for locking their digital assets in Yearn Vaults. These vaults employ automated algorithms that allow consumers to invest in various DeFi platforms while generating maximum rewards with minimal effort. Once a user deposits tokens into the vault, the protocol immediately begins collecting yield by moving the tokens across lending platforms.

Yearn’s other prominent products are yLocker and yPools. The former aims to tokenise locked governance positions in external DeFi systems. The latter are risk-adjusted, user-managed liquidity pools that hold a variety of liquid tokens, including yETH.

Every week, the yLocker stakeholder earns 100% of their protocol fees. Yearn’s vaults allow users to earn huge rates, making it suitable for investors looking to maximise the value of their holdings without actively trading.

6. Rocket Pool: Node Staking

Key Features

- Supported cryptocurrency: ETH

- APY: 2.65% (liquid stake) and 4.41% (node stake).

- Minimum stake amounts: 0.01 ETH (liquid staking) and 8 ETH (node staking).

- Reward Distribution: Every 28 days.

- There is no minimum lock-up period.

- A low entrance barrier for ETH staking.

- Can integrate with exchanges, lending platforms, oracles, and vaults.

Rocket Pool is a DeFi crypto staking platform that allows users to earn ETH rewards through liquid or node staking. Liquid stakers will receive rewards in the form of rETH tokens, which can be utilised in a variety of DeFi protocols. Staked tokens can be unstaked at any moment, and there are no minimum lock-up periods.

Node staking entails running a validator node in exchange for payouts in the form of ETH and RPL tokens, plus commission fees. To operate a node, users must stake at least 8 ETH. Staking payments are given every 28 days, and node operators who stake their RPL tokens receive additional bonuses and voting rights.

Rocket Pool makes Ethereum staking more accessible by lowering the entrance barrier from 32 ETH to 8 ETH for node staking and 0.01 ETH for liquid staking. This makes it the preferred platform for ETH trades. An additional requirement for RPL collateral exists, which can generate up to 8% in RPL incentives. However, if RPL continues to fall in value relative to ETH, this presents further risk.

7. Frax Finance: Stablecoin-Based Staking & Lending

Key Features

- Supported cryptocurrencies: stablecoins.

- APY: 5.90% for FRAX.

- Minimum Staking Amount: Depends on the asset and staking term.

- Reward Distribution: Based on the token.

- Lock-up period: one week to four years.

- Uses a fractional-algorithmic methodology to optimise stablecoins.

- Provides a permissionless, non-custodial lending platform.

- issues its own stablecoins.

Frax Finance is a DeFi platform designed to improve the stability of stablecoins through novel approaches. These include Fraxswap, an AMM with an in-built time-weighted average market maker, and Fraxlend, a permissionless and non-custodial lending platform that allows lending between any two ERC20 tokens.

Frax Finance is now issuing three stablecoins: FRAX (stablecoin pegged to the US dollar), FPI (stablecoin linked to a basket of consumer items), and frxETH. Its ecosystem is powered by two tokens: FXS and FPIS, which can be locked in liquidity pools in exchange for veFXS and veFPIS tokens.

Frax Finance’s DeFi coins have the ability to alter the financial landscape by providing unique liquidity solutions. This is especially true for Frax Ether (frxETH), which allows ETH holders to participate in the staking process without running a node. Stakers can earn additional benefits by exchanging frxETH for their staked versions, sfrxETH.

8. Pendle Finance: Yield Tokenization

Key Features

- Supported cryptocurrencies include Ethereum, Arbitrum, BNB Chain, and Optimism yield tokens.

- APY: 15.52% (sUSDe), 17.58% (USDe) y 18.77% (eUSDe).

- Minimum Staking Amount: Based on the token.

- Reward Distribution: Following the maturity date.

- Lock-up Period: Up to two years.

- Unique yield tokenisation model

- AMM designed for assets with time-decaying characteristics

- Liquidity providers might increase their compensation by up to 250 percent.

Pendle Finance is a permissionless yield trading platform that tokenises its users’ yields by converting them into standardised yield tokens. Pendle is a relatively new platform that has rapidly gained popularity in recent years. These tokens are classified as Principal tokens (PT) and Yield tokens (YT). This separation allows investors to trade future yields as independent assets.

Users who stake PENDLE tokens earn vePENDLE tokens. These coins are used to vote on which pool should earn PENDLE incentives. Those who vote will receive 80% of the swap costs from the voted pool. Liquidity providers can increase their PENDLE payouts by up to 250%.

Pendle has been regarded as one of the most promising RWA cryptocurrencies. It facilitates future yield trading by allowing investors to segregate yield-bearing assets into yield and principal components. Join Pendle and earn up to 18.77% on staked tokens.

9. EigenLayer: Restaking

Key Features

- Supported cryptocurrencies: ETH, liquid staking tokens (stETH, rETH, cbETH, and LsETH), ERC-20 tokens, EIGEN.

- APY: Based on the token.

- The minimum stake amount is 32 ETH (for native restaking).

- Reward Distribution: Following an activation wait (1 week on the mainnet and 2 hours on the testnet).

- Lock-up Period: Determined by procedures.

- Restaking mechanism

- Liquid and local restaking models

- Free-market governance

If you’re looking for DeFi staking platforms that allow users to stake their tokens, consider EigenLayer, a DeFi protocol that allows users to recapture staked ETH or LSTs to help secure its Autonomous Verifiable Services (AVSs). The restocking procedure employs both liquid and native restocking models.

Liquid restaking involves depositing liquid tokens, ERC-20 tokens, and EIGEN tokens into EigenLayer’s smart contracts. Native restaking enables users who operate an Ethereum validator node to change their withdrawal credentials to EigenLayer’s smart contracts. Stakers can also delegate their restaked balance to a node operator.

Node operators will earn a fixed 10% fee, while the rest will go to their delegators. However, they’ll also be able to set their fee rate to any amount from 0% to 100%. In short, EigenLayer will enable you to restake your tokens to improve your capital gains.

10. EtherFi: Non-Custodial Staking

Key Features

- Supported cryptocurrencies: ETH, stETH.

- APY: 3.8%

- Minimum Staking Amount: 2 Ethereum bonds (solo stakers)

- Reward Distribution: Quarterly

- There are no lock-up periods.

- Permissionless node staking and withdrawal

- Integration with EigenLayer.

- Loyalty points will boost rewards and give you access to airdrops.

EtherFi is a non-custodial liquid staking platform where Ethereum holders can stake ETH or stETH in exchange for eETH. The eETH token allows its holders to earn staking rewards and loyalty points. These points can be used to increase your prizes and obtain access to some of the most popular airdrops. ETH yield vaults allow users to automate their earnings by depositing eETH, weETH, or WETH tokens.

EtherFi offers many non-custodial staking solutions, ranging from solo to liquid staking. Users can also reinvest their ETH using Eigenlayer to boost their rewards. The staking benefits will be distributed as follows: 90% will go to stakers, while node operators and the protocol will receive 5%. Join EtherFi to receive attractive staking rewards through liquid and solo staking, and improve your strategy with Eigenlayer’s restaking collective.

Our Review Criteria?

We rated and reviewed the above-mentioned DeFi staking platforms using the following criteria:

- APY: Annual percentage yield, or APY, is a measure that represents the expected annual returns that stakeholders can earn on their staked tokens. APYs may be fixed or variable. The former is predetermined, but the latter is influenced by a number of factors, including the network inflation rate, platform fees, and the number of staked tokens.

- Reward Distribution: Investors who place their tokens in staking pools will earn staking incentives, which may include additional tokens, liquidity tokens, governance tokens, block rewards, and transaction fees. The payout amount will be determined by numerous criteria, including the number of staked tokens and transaction costs.

- Staking Methods: Staking can be done actively or passively. The former relates to verifying transactions and establishing new blocks for rewards, whilst the latter refers to securing tokens in staking pools or delegating stake to other validators. We highlighted platforms that provide a variety of staking choices, including solo, pool, and SaaS staking.

- Lock-Up Periods: Lock-up periods incentivise investors to make long-term commitments, which is critical for blockchain security and sustainability. This is why several DeFi platforms include lock-up periods of varying lengths.

- User Experience: A good DeFi platform will be user-friendly, with simple dashboards. We favoured systems that provided staking lessons and tracking tools, allowing investors to track their rewards in real time.

What Are the Different Types of DeFi Staking?

There are multiple types of DeFi staking:

- Proof-of-Stake Staking: DeFi’s most frequent staking mechanism is Proof-of-Stake (PoS). To gain incentives, investors must lock their tokens for a specified length of time, typically in the form of more tokens. The purpose of PoS staking is to validate blockchain transactions.

- Liquid Staking: Liquid staking tries to increase liquidity for trading pairs. Liquid stakers will receive both staking prizes and liquid staking tokens. These tokens can be used on multiple DeFi platforms.

- Governance Staking: Investors can gain voting rights by locking their tokens. A bigger quantity of locked tokens equates to more voting power.

- DAO Staking: The purpose of DAO staking is to sustain DAO operations. If the platform includes a revenue share mechanism, stakeholders will receive voting rights as well as a piece of the revenue.

- NFT Staking: NFT staking involves locking non-fungible tokens into DeFi systems or protocols for incentives. Rewards are typically in the form of governance tokens or in-game assets.

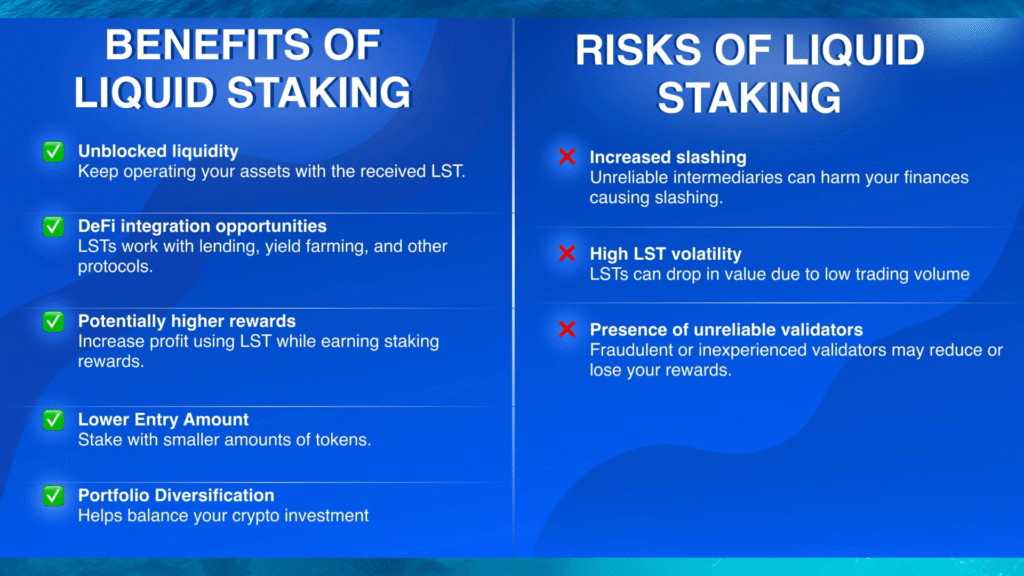

Benefits and Risks of DeFi Staking

Is staking coins worthwhile? Staking platforms provide numerous perks to encourage investors to participate in their DeFi ecosystem. The most significant advantages of adopting DeFi systems are also associated with risks:

Advantages

- Accessibility: DeFi systems simplify the staking process, making it accessible to anyone, including those new to cryptocurrency. In contrast to running a complete node or mining, DeFi staking does not require any technical knowledge. The majority of DeFi platforms are beginner-friendly.

- Passive Income Generation: DeFi staking allows investors to obtain passive revenue by locking their tokens for a set amount of time. This ensures a consistent flow of income without requiring active trading.

- Decentralized Control: Decentralised management: DeFi staking eliminates intermediaries like brokers and banks, giving investors full management of their assets. This lessens the likelihood of asset loss and lowers transaction costs.

- 24/7 Markets: DeFi markets operate around the clock, allowing investors to immediately respond to market movements.

- Governance: Governance tokens are used by several DeFi platforms to give stakeholders voting rights and influence the platform’s future direction.

Disadvantages

- Slashing: Slashing is a penalty mechanism in proof-of-stake (PoS) networks that discourages improper behaviour and promotes network security. If a validator engages in malicious behaviour or fails to meet network criteria (for example, lengthy unavailability), a percentage of their staked coins may be deducted.

- Lock-Up durations: Some DeFi platforms need staking terms that include lock-up durations. Stakers will not have access to their tokens until the lock-up period expires. If the cryptocurrency market experiences substantial price movements, the staked tokens may overwhelm the interest collected on them.

- Impermanent Loss: Fluid staking presents unique issues, such as impermanent loss. Impermanent loss occurs when the price of staked tokens fluctuates drastically, and locked tokens in liquidity pools lose value relative to their current market value.

Mistakes to Avoid When Staking DeFi Tokens

Even seasoned stakeholders make mistakes. Avoid the following frequent pitfalls:

- Ignoring lock-up terms may prevent you from accessing your funds when needed.

- Focussing just on high APYs might lead to increased risk.

- Skipping audits: Platforms without audits may expose funds to smart contract flaws.

- Avoid relying on a single coin or platform without diversifying.

- If you don’t have an exit strategy, it’s important to know when and how to withdraw from a commitment.

When you unstake DeFi tokens, it is typical to experience an unbonding wait before they are functional again. Some platforms may also incur fines if you unstake before the lock-up time expires, so always read the terms carefully.

Don’t forget that unstaking frequently entails paying a tiny gas price, particularly on networks like Ethereum. Because each platform operates differently, it is critical to follow the proper unstaking guidelines supplied by the platform you utilized.

Take Home

DeFi staking is a game-changing approach that enables crypto staking for anyone with an internet connection. The top crypto staking platforms also allow people and organisations to create passive revenue through solo, pool, and SaaS staking, while liquid staking allows for interactions with DeFi protocols.

As DeFi systems grow, staking payouts will become more competitive, driving institutional adoption. To maximise DeFi staking, select a platform that is compatible with your objectives. Look for renowned teams, solid security measures, and clear reward structures. Begin investigating today and take advantage of the earning potential in decentralised finance!