Regular individuals like you can access crypto’s proof-of-stake networks through Kraken crypto staking pools without having to operate complex hardware or lock up a significant quantity of coin. Along with other pool players, you share the work and, naturally, the profits of your staking. It’s a simple method to assist safeguard the network and convert cryptocurrency assets into consistent passive revenue.

Before you get into the Kraken staking pool we are discussing in this post, let’s go over all the important things you should know.

What Is a Staking Pool?

A staking pool, is a collection of cryptocurrency holders who pool their coins in order to take part in a proof-of-stake (PoS) network. All the delegators pool their staked assets into a single pool rather than staking independently. The pool is managed by a pool operator, who utilizes the required validator keys to operate the validator. This pool serves as a single, huge validator, protecting the chain and gaining rewards in the network’s native currency.

However, why is working together preferable than working alone? To perform solo staking, you need to have the full minimum stake for the chain (for example, at least 32 ETH is necessary to stake on Ethereum) as well as constant validator uptime and technical expertise. Members of crypto staking pools collaborate to share resources, increase their combined staking power, and raise their chances of successfully verifying transactions. This implies that even modest landowners may be able to benefit from incentives that are often only available to big companies.

How Staking Pools Work?

Staking pools transform a challenging individual task into a collaborative effort. They adhere to the same principles as any proof-of-stake network, but they divide the process into manageable segments, allowing more participants to get involved. Let’s explore how the staking mechanism operates.

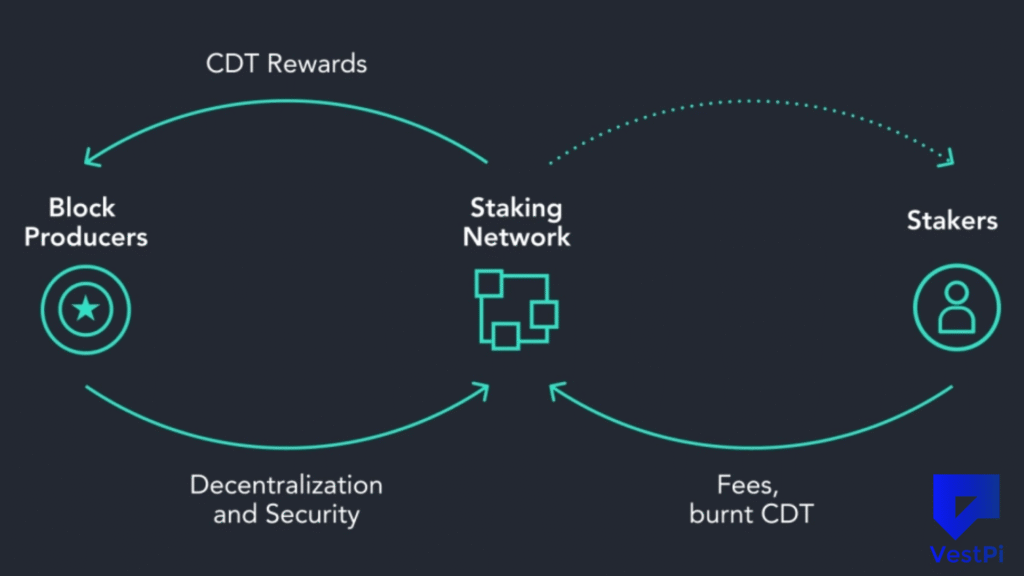

1. Consensus Mechanism

Everything begins with the consensus method. In PoS blockchains, validators protect the chain by pooling their coins and verifying new blocks. Other blockchains utilize delegated proof-of-stake (DPoS), where token owners vote for validators instead of operating them directly.

Regardless of the method, the network requires validators to maintain integrity. However, the entry threshold is too high for many people, and being a validator demands consistent online presence. This is where pools come in: they leverage delegation to integrate smaller holders into the operation. Participants combine their resources and can actively contribute to the security of the chain.

2. Pooling Resources

Rather than staking independently, users merge their funds into a communal pool. The blockchain views this entire pool as a single substantial stake. This increases the chances for everyone involved to be chosen for block production. Imagine it like accumulating lottery tickets: a larger stack improves the likelihood of winning. Pooling enhances access to the system, but the size matters only if the network decides to select that validator.

3. Validator Selection

Once all the resources are pooled, the blockchain needs to choose a validator. The selection is random but influenced by the amount of the stake. A larger pool means a better chance of being picked to validate the next block. After selection, the validator carries out its responsibilities—validating transactions and adding new blocks. The selection process determines who receives the rewards, which is the primary concern for every delegator.

4. Earning Rewards

When a validator from a pool gets selected, it collects staking rewards in the native token of the chain. These rewards generally originate from network inflation and transaction fees. The pool then implements a distribution process to share the earnings among delegators. Your portion corresponds to your stake relative to the total pool amount.

For example, if you stake 1% of the pool’s total, you will receive 1% of each payout. In Ethereum, annual returns have fluctuated from 20% in 2020 to around 5% in 2024, with more ETH entering the pools. Rewards are the primary motivation for delegators, but before any payments can be deposited in your wallet, the pool takes its fees.

5. Pool Fees

All staking pools impose fees to manage expenses and compensate the pool operator. This commission is typically a percentage of the rewards, although some networks may add fixed fees. For example, on Ethereum, most pools charge roughly 10%. Reduced fees lead to increased rewards for delegators, but a dependable operator can often justify the expense. Fees are the last element of the process: they are deducted after rewards are accrued and prior to payouts being sent to your withdrawal address.

Types of Staking Pools

Numerous types of staking pools exist, with their configurations affecting their safety, flexibility, and openness. You’ll encounter three primary distinctions: custodial versus non-custodial, public versus private, and centralized versus decentralized.

Custodial and Non-Custodial Pools

A custodial staking pool retains your cryptocurrency. You place it with a service provider, typically an exchange, which manages the validator on your behalf. The benefit is ease of use, while the downside is the risk involved with custodianship: you forfeit your private keys and must trust the provider to act honestly and adhere to KYC/AML regulations.

Conversely, a non-custodial staking pool operates differently. You maintain ownership without relinquishing control. Your coins remain in your wallet or within a smart contract that only you are permitted to access. This approach mitigates custodial risk and ensures greater security for your funds. Cardano features over 3,000 independent pools exemplifying this non-custodial framework.

Public and Private Pools

Public staking pools are open to everyone. They reduce obstacles, distribute staking resources, and enable all participants to earn staking rewards. This model is prevalent in networks such as Ethereum and Solana.

In contrast, private pools limit access. They may be operated by a corporation or a single party with their own funds. Occasionally, operators may require a pool pledge or a minimum investment, which can exclude smaller holders. While private pools might offer improved management, they also limit community involvement.

Centralized and Decentralized Pools

A centralized staking pool is governed by a singular entity or platform. They typically manage substantial amounts of staked assets; for instance, Lido oversees nearly 24% of all staked ETH. However, this concentration of power poses a risk: excessive control in a single location can jeopardize network safety.

Decentralized pools distribute authority among various operators. They depend on code, permit open participation, and sometimes incorporate DAOs. This structure diminishes reliance on a single operator, yet increases risks associated with smart contracts and liquidity if the tokens do not trade well.

Staking Pool Returns

The returns from a staking pool depend on three factors: the amount you stake, the duration of your investment, and the specific rules of the network. Pools provide consistent rewards, but these are not guaranteed.

Rewards originate from two avenues: network inflation (the issuance of new coins) and transaction fees. The pool then implements a system for distributing rewards. Your portion is determined by your contribution to the overall pool. If you stake 2% of the total, you would receive roughly 2% of each reward payout.

The reward rate (APR/APY) within staking pools fluctuates over time. Early Ethereum stakers experienced an APR of 20%, but by mid-2024, as the total ETH staked rose to 28%, the APR decreased to around 4%. Currently, Cardano averages about 4. 5%, Polkadot approximately 9%, and Solana near 6%.

Compounding can enhance these returns. This is the method of reinvesting your rewards to earn additional income. Some pools also provide restaking options, where tokens are secured on multiple chains simultaneously for greater yields.

Both compounding and restaking can amplify your prospective passive income, but may also introduce additional fees and complexities. Kraken offers a version that enables users to stake eligible assets in flexible mode (withdrawing any time) or in bonded/locked mode (assets committed for a predetermined period) to garner rewards.

Why Kraken offers “Up to 21%” Yield

On Kraken’s staking platform, you’ll notice prominently displayed reward percentages such as “up to 21% annually. ” Let’s clarify what this signifies:

- The “up to” percentage pertains to certain assets and specific bonded staking durations (that is, funds locked for a set time) instead of applying universally to all assets or flexible staking options.

- For instance, the platform indicates an annual percentage rate (APR) of approximately 16-22% for bonded staking on Cosmos (ATOM).

- In comparison, more widely recognized assets like Ethereum (ETH) exhibit much lower percentages (ranging from 2% to 6. 5%) for bonded staking conditions.

- Kraken deducts a portion of the rewards generated (for instance, a 20% fee in the UK/EEA for bonded staking).

- The rewards are subject to change based on factors such as network status, the length of the staking period, the specific asset, and whether the staking is flexible or bonded.

Therefore, while a 21% return is achievable, it only applies in certain situations. It’s essential to comprehend the details concerning the type of staking and the assets involved.

Realistic Yield Expectations and Example

Here’s a more detailed explanation of what to anticipate:

| Asset | Staking Type | Approximate APR* | Notes |

|---|---|---|---|

| Cosmos (ATOM) | Bonded ~21 days | ~16-22% | High yield token; locked term applies |

| Kusama (KSM) | Bonded ~7 days | ~12-19% | Shorter term, high variability |

| Ethereum (ETH) | Bonded ~14 days | ~2.25-6.5% | More conservative yield; major asset |

| General Flexible Staking | No fixed term | Varies, lower end | Unlocked access, lower reward potential |

APR estimates provided by Kraken; actual profits may differ depending on Kraken’s commission and the network.

Example Calculation: The net yield would be as follows if you staked 1,000 ATOM at 20% APR (for simplicity’s sake) and Kraken charged 20% commission on rewards:

- Gross reward: 200 ATOM annually (1,000 × 20%).

- Twenty percent Kraken commission: 200 × 20% = 40 ATOM

- Annual net reward: 160 ATOM => net effective yield of about sixteen percent

Step by Step on How to Join Kraken Crypto Staking Pools

- Create an account on Kraken or sign in.

- Purchase or deposit a staking asset that qualifies (e.g., ATOM, KSM, DOT, etc.).

- Open Kraken and navigate to the Staking or Earn area.

- Select the staking mode:

- Flexible staking: You can unstake at any time using flexible staking, although the return rate might be smaller.

- Bonded staking: A greater rate is available; the asset is locked for a specified period.

- Accept the terms (unbonding period, etc.) and choose the term (if applicable).

- Get weekly prizes for staking that are credited to your account.

- Keep an eye on your incentives and choose whether to restake or withdraw at the end of the term (if bonded).

Benefits of Joining a Staking Pool

Staking pools provide broader access, distribute risk, and help you earn consistent passive income through regular staking rewards, all without the hefty initial investment. Let’s explore each of these advantages in more detail.

1. Higher Likelihood of Rewards

When staking alone, validating a block can seem more like a lucky lottery win than a means of earning passive income. A staking pool enhances these chances because it allows members to pool their stakes together. The larger total in the pool improves the likelihood of being selected for validation. When it succeeds, you receive a portion through the reward-distribution system. This ensures that you’re continuously receiving rewards, rather than sporadic payments.

2. Lower Minimum Staking Limits

Staking independently often requires substantial minimum amounts. For instance, Ethereum mandates 32 ETH to operate your own validator, which is roughly $140,000 as of August 2025. This amount is unattainable for many individuals. Staking pools eliminate this restriction by permitting you to invest any minimal amount. Some allow you to start with just a few dollars’ worth of tokens. Staking pools enable you to participate with a smaller investment and still receive rewards. This is why they have become the go-to option for smaller investors.

3. Decreased Risk

Operating a validator independently means dealing with hardware costs, uptime requirements, and the potential for slashing penalties if you make errors. Joining a pool shifts these responsibilities onto the operator. While you may still encounter certain risks (such as counterparty risk when using a custodial pool), many of the headaches can be mitigated by being part of a staking pool. Additionally, pools provide consistent income. Rather than experiencing large gains or nothing at all, you receive smaller, predictable rewards. This steadiness helps manage overall risk while continuing to grow your stake.

4. Equal Opportunity Access

One of the most significant advantages of staking pools is the accessibility they offer. Staking pools create opportunities for anyone to take part in securing digital assets, not just large investors with significant stakes. By including more participants in proof-of-stake systems, they distribute resources and enhance security. Increasing the amount of staked cryptocurrency keeps blockchains equitable and driven by the community, ensuring that pool staking isn’t limited to an elite few.

Possible Downsides

While staking pools address various issues, any beneficial option carries its own set of potential risks. From fees to operator actions, fluctuations in token prices, and delays, there are considerations you should evaluate before investing any money.

1. Fees Charged by Pool Operators

Every pool imposes fees. Pool operators manage hardware, ensure uptime, and maintain security, and they charge a commission for their services. In Cardano, this amounts to at least 340 ADA per epoch plus a margin. In Ethereum, pools operated by exchanges often take around 10%. These fees reduce your overall payout. Although lower fees can increase your net earnings, higher-quality services sometimes come at a greater cost. Always weigh the fee amount against the reliability of the service.

2. Improper Actions by Pool Operators

All staking pools demand a certain degree of trust, particularly in custodial staking pools, as you are putting your assets in someone else’s hands. An operator may act contrary to your benefit by going offline, obscuring fees, or mismanaging your stake. This creates custodial risks and the possibility that a service provider could lose or withhold your funds. Choose operators with a strong reputation, clear guidelines, and open practices.

3. Price Fluctuations

Earnings become irrelevant if the price of the token plummets suddenly. Staking offers some protection against network inflation but does not guard against market fluctuations. Even with promising rewards, token prices can decline more quickly than your earnings accumulate. Polkadot’s approximately 9% APR may seem appealing, but a sudden price drop could eliminate those gains. This isn’t an investment suggestion, but a reminder that market risks do exist. While pools can generate a source of passive income, they are not a hedge against cryptocurrency’s volatility.

4. Withdrawal Delay

Exiting a staking pool isn’t always a quick process. Many blockchain networks have an unbonding period or lock-up time before you can take out your assets. For instance, Cosmos requires about 21 days, Polkadot around 28 days, and Ethereum operates with an exit queue. During this time, you cease earning rewards and cannot make any sales. If the market changes, you may find yourself in a difficult spot. Some liquid staking opportunities address this with tradable staking tokens, but this introduces its own penalties and liquidity challenges. Always familiarize yourself with the withdrawal policies before staking in a pool.

Notable Cryptocurrencies Offering Staking Pools

Here are four prominent Proof of Stake blockchains where you can participate in staking pools, with data as of August 2025.

- Ethereum (ETH): Ethereum demonstrates robust staking activity. Approximately 29. 6% of all available ETH is currently staked, contributing to the network’s security and providing consistent rewards for delegators. This level illustrates the significance of staking pools within Ethereum’s ecosystem.

- Cardano (ADA): Cardano excels in widespread engagement. About 60% of all ADA is currently staked, amounting to 21. 2 billion ADA tokens dedicated to maintaining network security.

- Polkadot (DOT): Polkadot also displays considerable participation. Nearly 49% of its total DOT supply is staked through nomination and pooling, enhancing both the security and governance of the network.

- Solana (SOL): Solana has a high staking rate, with around 66% of circulating SOL staked. The network employs automatic validator rebalancing to ensure that stakes are evenly distributed throughout the system. This indicates strong user confidence and highlights the appeal of crypto staking pools on this rapidly developing blockchain.

How to Choose the Right Staking Pool

Not every staking pool is deserving of your investment. The ideal selection takes into account fees, size, and trustworthiness. Here are the important aspects to consider before you delegate your staked assets.

- Staking pool charges: Each pool takes a portion of your investment. Pay attention to the fee structure, which typically ranges from 5 to 10 percent, in addition to any fixed fees. If the fees are lower, you may earn more rewards; however, a reliable operator often justifies higher costs.

- Minimum staking amount: Certain pools require a minimum investment to participate. For solo staking on Ethereum, you need to have a significant amount of ETH, while most staking pools allow you to get started with a much smaller investment. Verify the requirements before you proceed.

- Size of the pool: A larger pool implies better chances for validating blocks. However, very large pools may lead to lower earnings or increased centralization. Medium-sized pools generally provide a good mix of returns and decentralization.

- Pool commitment: In some blockchains, a pool commitment means the operator’s personal stake is locked up within the pool. A higher commitment indicates a vested interest in the pool, aligning the operator’s goals with your own.

- Current stake: The current stake reflects how much is actively being staked in a pool at this time. It allows you to assess the pool’s activity level and to see if it is nearing saturation (the stage at which rewards may decrease).

- Pool evaluation: Numerous networks offer a ranking for pools based on their performance and rewards. Utilize this information to compare different options, but avoid simply going for the top-rated ones, as spreading your investments across multiple pools can help mitigate risk.

Closing Remarks

With crypto staking pools, you don’t require extensive server systems or vast amounts of money to join; just coins, a wallet, and some basic knowledge. Staking pools enhance both security and accessibility within PoS networks, allowing you to earn a little extra along the way. They enable participation for everyone, not only the major investors, in shaping the future of blockchain technology.

Staking with Kraken provides an easy way to generate passive income from your cryptocurrency assets. Although the headline of “up to 21%” is attention-grabbing, this rate is applicable only to certain assets under specific locked conditions — not all assets will yield this return.

By grasping the various factors (asset type, duration, fees, lock-in period, and risk), you can make well-informed choices and strategically position your portfolio to take advantage of staking rewards. As always, remember to diversify your investments, evaluate risks, and ensure that your staking approach aligns with your broader investment objectives.