Note that this is not a secret formula reserved for geniuses. It’s a quite simple, repeatable crypto project research checklist that will protect you from hype and help you find the real gems.

You’ve sensed it. When you see a new cryptocurrency project taking off on X (Twitter), you get that intense, stomach-churning surge of FOMO. Everyone is yelling about 100x gains, the chart is a vertical green line, and you have a desperate want to buy in now to avoid missing the rocket ship.

The process of researching a cryptocurrency project before investing is shown by an illustration of a detective using a magnifying glass to examine a holographic crypto project.

The majority of novice investors lose their money at this point. They jump before they see, caught up in a tale spun by rumors and excitement. However, the harsh reality is that there are a hundred projects that are bound to fail for every one that yields transformative results.

Research, not luck, is what separates a wise investment from a risky gamble. However, “Do Your Own Research” (DYOR) comes across as an order that is threatening and ambiguous. In reality, what does that mean?

It indicates that you require a system. That system is this one. I use this straightforward, scalable platform to weed out the noise, steer clear of scams, and find initiatives that are truly made to stay.

The Renewed Mindset: From a Gambler to a Detective

To begin, it is imperative that you cease thinking like a gambler searching for a hot tip. You must adopt the mindset of a private investigator looking into a very important case. Gamblers tend to follow the herd. A detective looks for evidence.

It is not your responsibility to forecast the cost. It is your responsibility to evaluate the project’s basic quality. Despite the short-term market instability, a high-quality project has a far higher chance of long-term success. This framework serves as a checklist for your research.

Step 1: What Problem Does This Actually Solve?

This is the first and most important question you have. You must grasp the project’s main goal in a single line before you become engrossed in the technology or the token price.

“What real-world (or digital-world) problem is this project solving?” is the question to ask.

- Where to look: The whitepaper’s introduction and the project’s official website homepage. Just the first few pages need to be read; the rest is not necessary yet.

- A Green Flag: The issue is described in plain, easy-to-understand terms. The answer makes sense and is simple to understand. “We are creating a decentralized version of YouTube where creators have complete control over their audience and their content,” for instance.

- A Serious Red Flag: The website is a wall of empty phrases like “a decentralized metaverse protocol for the new paradigm of Web3 that is synergistic and powered by artificial intelligence.” They frequently don’t do anything at all if they can’t clearly describe what they do.

Step 2: Who is the Team Behind the Curtain?

When you invest in a project, you are placing a wager on the team’s capacity to carry out the idea, not only on the idea itself. This lesson comes directly from the venture capital industry.

“Is the team public, experienced, and trustworthy?” is the question to ask.

- Where to look: The project’s website’s “Team” or “About Us” section. To become a mini-stalker is your task. Google the names of the founders. Check out their X (Twitter) accounts and LinkedIn profiles.

- A Green Flag: The group has a proven track record of success and is doxxed, or publicly identified. Perhaps the chief developer has experience working on other successful cryptocurrency projects, or the founder was formerly employed by a large IT business. They need to preserve their reputation.

- A Huge Red Flag: The team solely uses cartoon avatars and fictitious identities to identify themselves; they are totally anonymous. A scammer’s biggest friend is anonymity, even though it is a component of the crypto culture. An anonymous group may pull a rug pull or give up on a project.

Step 3: What are the Tokenomics?

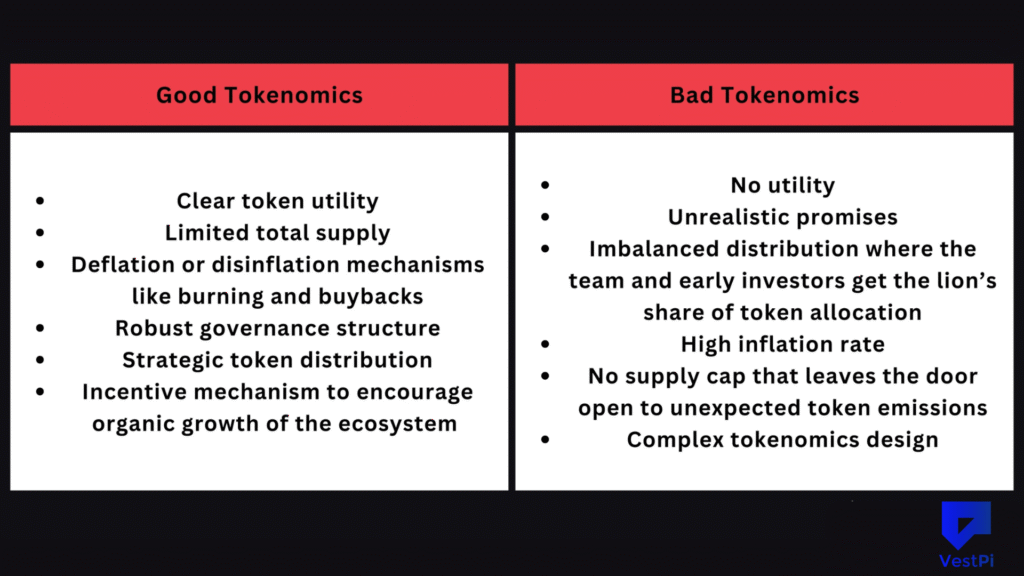

The secret killer of many seemingly fantastic projects, this is the section that most novices overlook. The study of a token’s economic structure is known as tokenomics. The ruleset establishes whether the token is intended to enrich insiders or to increase in value over time.

The significance of tokenomics in crypto research is demonstrated by a symbolic picture that contrasts a cryptocurrency coin on a stable basis called “Good Tokenomics” with one on a deteriorating foundation called “Bad Tokenomics.”

The Three Most Important Questions to Pose:

- What is the utility of the token? With it, what can you do? Does it cover transaction costs? Does it grant you the ability to vote on the governance of the project going forward? Is it possible to stake it and get rewards? People will naturally purchase and hold a token with genuine, integrated utility.

- What is the SUPPLY of the token? Does the supply have a cap, similar as the 21 million Bitcoins? Or is there an endless supply? A project that can be printed into oblivion is not nearly as appealing as one that has a fixed or deflationary (supply-reducing) mechanism.

- What is the distribution of the token? The coins belong to whom? Look for a token distribution chart in the whitepaper. The ownership of 60% or more of the supply by the “Team,” “Advisors,” and “Private Sale Investors” is a serious red flag. This implies that these insiders have the ability to “dump” their substantial holdings into the market, causing the price for individual investors to plummet.

Step 4: Is the Community Real?

A cryptocurrency project is a ghost town waiting to happen if its community isn’t active and involved. Its community serves as its first user base, its most ardent marketing team, and its most formidable barrier.

The Question to Ask: “Is the hype a paid-for illusion or is it real?”

- Where to Look: The Telegram and Discord communities for the project. Your role is to lurch, not to participate. Read the talk for half an hour.

- A Green Flag: A green flag is when people are discussing the technology, governance, and use cases in genuine, meaningful ways. The group is actively and openly responding to difficult, important queries.

- A Serious Red Flag: Despite having 200,000 users, the conversation is dead or is just a never-ending barrage of bots sending out “wen moon?” and rocket emojis. You have your answer if you pose a challenging query and it is removed or you are banned. Real initiatives are open to criticism.

Step 5: The Roadmap and Catalysts

There is always a wonderful project underway. A clear future vision and precise, impending events that might reveal fresh value are what you want to observe.

“What is the project’s plan for the next six to twelve months?” is the question to ask.

- Where to look: The project’s official website roadmap, as well as any current announcements on social media or in their blog.

- A Green Flag: A detailed, practical, and implementable business strategy is what the roadmap is. “Q3: Launch our V2 testnet and integrate with [XYZ protocol].” It displays a team that is shipping-focused.

- A Serious Red Flag: The roadmap is a hazy, buzzword-filled fantasy book. “Q3: AI synergy and metaverse integration.” If the team has a track record of routinely missing deadlines, that’s also a red flag.

Your 1-Minute Scam Filter

Lacking the time to thoroughly examine every project? By using this simple criteria, you may eliminate 99 percent of the most blatant scammers. Simply leave if two or more of these are answered “no.”

- Is the crew trustworthy and doxxed?

- Is the liquidity of the project locked in?

- Has a reputable company audited the smart contract?

- Is the allocation of tokens equitable?

Takeaway

Researching a crypto project is a talent that can be learned, not a dark art. It involves understanding where to look for the answers and posing the appropriate queries.

You can become a disciplined investigator who seeks for true, basic value instead of a hopeful gambler who chases hype by creating your own repeatable system. In this market, that is the only long-term route to success.