For complete beginners, cross-chain swaps include crypto bridging and token swaps, represent another step toward seamless multichain interactions, allowing users to efficiently use their assets across blockchains. This article will go over how cross-chain swaps work, the many types, the benefits, challenges, and why cross-chain swaps matter.

What Is A Cross-chain Swap?

A cross-chain swap allows you to swap one chain’s token for another’s. For example, swap USDT on Arbitrum for ETH on Base. Unlike typical swaps on centralized exchanges, cross-chain swaps allow for direct transactions between blockchains.

Cross-chain swaps combine the functions of bridging and swapping into a single operation. Rather than executing numerous processes, such as bridging an asset to a new chain and then swapping it for another token, cross-chain swaps enable efficient asset management across networks without the need for centralized middlemen.

These acts are useful for a number of reasons, including:

- Eliminating the need to bridge and swap individually, which streamlines asset movements.

- Allowing you to accomplish complex asset transfers in one step rather than several.

- Helping you optimize liquidity by managing tokens across chains without having to maintain balances in several wallets.

Cross-chain swaps are extremely effective instruments for multichain DeFi interactions. When implemented successfully, they can assist users (like you) in realizing the full potential of the multichain multiverse.

How Does A Cross-chain Swap Work?

Cross-chain swaps use a variety of techniques to enable asset transactions between blockchains. Crypto bridges are one of the most commonly used methods. Some bridges use this strategy to lock tokens on a source blockchain and mint/wrap tokens on the destination chain, which can subsequently be exchanged for a desired asset.

You’re undoubtedly wondering, “Bridge and swap separately?” “I can just do it myself.” You could, but using a cross-chain protocol to achieve this result automates the entire process, reducing the user experience to as few steps as feasible. Furthermore, this is only one method for carrying out cross-chain swaps.

Types of Cross-Chain Swaps

There are many types of cross-chain token swaps or swapping currently available. They work in slightly different ways. These are the major ones:

- Over-The-Counter (OTC) Swaps: These are trust-based transactions between parties. These swaps have significant risks, such as counterparty default (the seller backing out after receiving payment), and are often unsuitable for decentralized systems.

- Hash Time-Locked Contracts (HTLCs): HTLCs are an early technique for cross-chain swaps. They use cryptographic hash functions and time-based escrow to make transactions between parties easier. While secure, HTLCs have limited scalability and usability, making them unsuitable for wider usage.

- Atomic Swaps: Atomic swaps allow for direct, decentralized trades between chains. While they are consistent with decentralization ideas, they require both chains to support specified technological constraints, which limits their adaptability.

- General Message Passing (GMP): General message passing (GMP) automates cross-chain swaps by allowing chains to communicate and conduct transactions. GMP introduces concerns such as data integrity issues and messaging protocol flaws, which might jeopardize the security of a swap.

- Interoperability Platforms: Interoperability platforms facilitate communication between blockchains, including token swapping.

- Proxy Tokens and Wrapped Assets: This form of swap is generally referred to as bridging. It refers to the process of exchanging one token for its counterpart on another chain so that it can be used in the new environment.

What Are the Benefits of Cross-Chain Swaps?

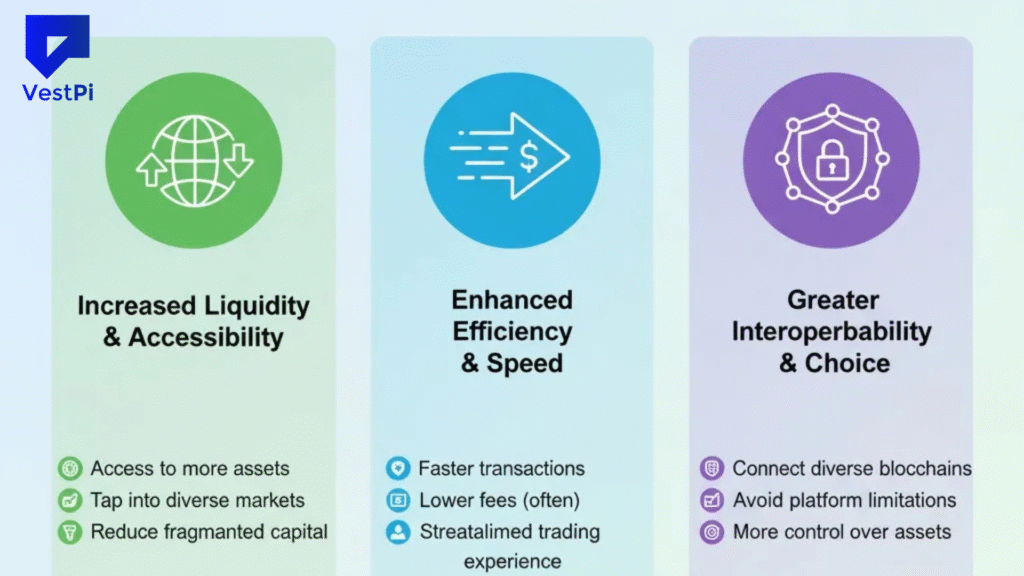

Cross-chain crypto swapping allows you to trade one cryptocurrency for another very quickly without dealing with money or going through a centralized crypto exchange. It’s faster, often cheaper, and provides access to a wider selection of tokens.

Most swaps take place on decentralized platforms, which provide more privacy and control than centralized exchanges. Finally, swapping simplifies cross-chain transfers, allowing you to move assets between blockchains without breaking a sweat.

Among other benefits, users of cross-chain exchanges profit from:

- Interoperability: Interoperability refers to the ability to access and use protocols and apps across several blockchains.

- Trustless Ownership: Trustless ownership eliminates the requirement for users to trust a third party, such as a central exchange.

- Better Experience: Cross-chain swaps simplify the process of swapping tokens between chains, eliminating the need for numerous procedures.

Common Challenges of Cross-chain Swaps

Hopefully, you now grasp the power of a cross-chain swap. However, they are not without their drawbacks, including as technological complexity, scalability issues, and potential security problems.

- Technical Complexity: Cross-chain swaps frequently entail complex procedures, such as locking and minting or message-passing systems, which can be difficult to implement and manage.

- Scalability Issues: Many existing techniques, such as HTLCs, struggle with liquidity constraints and lengthy transaction times, particularly during periods of high network demand.

- Security Risks: Security risks include smart contract vulnerabilities, dependency on validators, and use of representative assets, which can lead to hacks and exploits (e.g., the $624M Ronin Bridge hack in 2022).

Why Do Cross-chain Swaps Matter?

Cross-chain swaps are a key component of blockchain interoperability, allowing users to handle assets easily across various chains. By eliminating the need for centralized exchanges and intermediaries, they give users more control while maintaining the decentralization that web3 values.

The major point here is that cross-chain swaps make asset management simpler. Cross-chain swaps allow consumers to access possibilities on other chains by making it simple to shift cryptocurrency around. There is no need to juggle different wallets or go through time-consuming multi-step processes to make your cryptocurrency function for you anymore. The web3 environment is becoming increasingly borderless.

Beyond usability, this is a significant victory for developers because cross-chain swaps open up new opportunities for developing dApps with seamless multichain experiences. As the blockchain ecosystem becomes more interconnected (a mission Across is at the vanguard of), cross-chain swaps are critical for enhancing user engagement, fostering liquidity, and decreasing friction throughout web3.

Summary

Cross-chain swaps are actually an important part of the Web3 ecosystem since they are set up to break down “silos” long separating blockchain networks. For the fact that it allows a direct, decentralized asset transfer between multiple networks, they help to improve interoperability, thus, promoting liquidity in the DeFi sector, and giving users a more flexible and rewarding experience.

However, as with any other technology in its birth stage, it is advisable to be cautious and vigilant. And as new technology keep unfolding, we expect new solutions for overcoming overcome some security and scalability issues, and this will open a path way for a more resilient and efficient multichain future. Just in case new players wish to engage safely in the developing, interconnected Web3 environment, they must first understand both the possibility for change as well as the same for potential hazards involved with cross-chain swaps.