Just as the cryptocurrency ecosystem is booming, you need a good knowledge of the best crypto portfolio trackers, and how to make the most of them as an investor, big or small, so you don’t mistakenly under-value projects with huge potentials, or miss out on a life changing investment opportunity.

Crypto portfolio trackers that can assist you in monitoring the value of your digital assets across all of your exchanges, wallets, and blockchains are in greater demand than ever thanks to the proliferation of new exchanges, DeFi protocols, and wallets.

What is a Crypto Portfolio Tracker?

Crypto portfolio trackers are online platforms or software programs that give consumers a centralized, structured way to manage and keep an eye on their bitcoin investments.

These trackers offer up-to-date data on market trends, asset allocation, transaction history, and portfolio performance.

Investors can streamline their crypto investing plans, monitor profits, and make well-informed decisions by utilizing a crypto portfolio tracker.

Importance of Tracking Crypto Portfolios

For a number of reasons, keeping an eye on a cryptocurrency portfolio is essential. First of all, it gives customers a summary of how each cryptocurrency in the portfolio is doing, allowing them to determine which assets are doing well and which might need to be adjusted.

Second, it enables investors to make timely investment decisions by keeping them informed about the most recent news, price changes, and market trends. Last but not least, maintaining portfolios makes tax reporting easier by offering precise records of ownership and transactions.

List of Best Crypto Portfolio Trackers

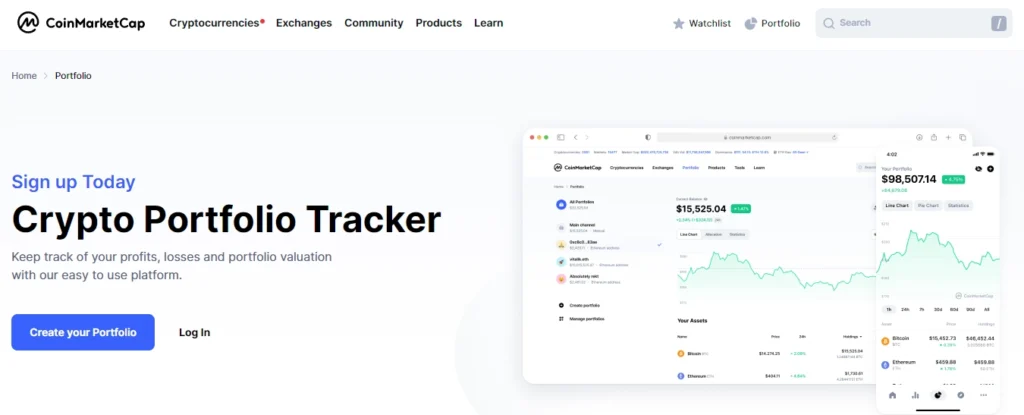

1. CoinMarketCap

One of the most reliable cryptocurrency price monitors in the world is CoinMarketCap. Investors can also purchase a portfolio tracking tool from the company. The platform may be a viable choice for traders on a tight budget who would rather manually enter their bitcoin holdings, despite its restricted features.

CoinMarketCap is one of the most reliable cryptocurrency price-tracking websites in the world. The business also offers a portfolio tracking tool to investors.

Despite its limited capabilities, the platform is a good option for traders on a tight budget who would rather manually enter their cryptocurrency holdings.

2. Blockpit

Blockpit is a complete solution made to meet the unique requirements of tax advisors and bitcoin traders. With its extensive support for over 100,000 cryptocurrencies, a wide range of crypto wallets, and many exchanges, Blockpit stands out in the crypto portfolio tracking market and provides investors with a wide range of operational options. View all of the integrations that are supported here.

The crypto portfolio tracker now tracks DeFi investments in addition to conventional assets and fully supports NFTs with extremely accurate pricing data.

Blockpit’s emphasis on regulatory compliance, which includes tools for thorough tax reporting and insights for tax efficiency, is its most notable feature. Users value its user-friendly interface because it makes the frequently difficult task of calculating crypto taxes related to crypto assets simpler.

Blockpit users will have a one-stop shop for all of their cryptocurrency investment tracking and tax reporting requirements thanks to this comprehensive coverage.

3. Delta

Delta Investment Tracker offers a strong platform to users with diversified and multi-asset portfolios. Cryptocurrencies, NFTs, equities, futures, and currencies are just a few of the many assets it supports.

With its real-time P&L analytics, in-depth asset analysis, and customized choices for tracking asset movement, Delta is known for assisting users in precisely managing their investments. The site takes pride in its ease of use and safe environment for tracking investments.

The software is appropriate for active investors who want direct management over their varied investment portfolios and is accessible on both iOS and Android. For further features and improved capabilities, users can also sign up for Delta Pro.

4. CoinStats

A thorough portfolio tracker, CoinStats provides up-to-date information on more than 3,000 cryptocurrencies. CoinStats’ user-friendly design and sophisticated features enable users to track market trends, set price alerts, and keep an eye on the performance of their portfolios.

Crypto aficionados find it to be a convenient option because to its connectivity with multiple wallets and exchanges.

5. Kubera

Kubera markets itself as a portfolio tracker made especially to support a variety of assets, such as NFTs and cryptocurrencies. In contrast to providing a free alternative, Kubera provides personal plans that start at $150 annually.

Additionally, Kubera provides capabilities like tracking numerous assets, identifying top performers, and both automatic and manual import choices.

What Makes a Good Portfolio Tracker?

You should look for the following features, albeit the “best” portfolio tracker for you may change based on your circumstances.

- Free version: If you’re unsure if a portfolio tracker is the perfect tool for you, you can test it out using the platform’s free edition!

- Integrations with exchanges and blockchains: Manually entering every transaction can be quite time-consuming and labor-intensive. That’s why many investors choose to employ portfolio trackers that automatically sync your transactions from blockchains and exchanges.

- Security: It’s crucial to pick a portfolio tracker that follows best practices when it comes to keeping your data secure.

Wrapping Up

To sum up, successful investment requires monitoring and maintaining your bitcoin holdings. A variety of features and advantages are provided by these portfolio trackers to assist you in keeping tabs on your investments.

These portfolio trackers provide real-time statistics, customisable features, easy-to-use interfaces, and interaction with wallets and exchanges, regardless of your level of trading experience. To optimize your cryptocurrency investment potential, you may efficiently monitor your holdings, evaluate market trends, set alerts, and make well-informed decisions by selecting the best portfolio tracker.