Whether you are an investor or a project owner, you must have an indepth knowledge of tokenomics and why it matters, and this goes for both newcomers and seasoned investors, scratching their heads.

In this post, we’ll break down the complexities of tokenomics and simplify it into an actionable framework for both investors and businesses alike. By the end of the day, you will not only understand what tokenomics is, but also know how to use it to make intelligent investment decisions.

With over 22,000 cryptocurrencies worldwide, and new ones being created every second, tokenomics allows you to make informed investment decisions in cryptocurrencies. Understanding the project’s fundamental economics allows you to properly assess its potential for growth and profitability.

It is not exclusive to the world of Bitcoin. Tokenisation can create new business models and revenue sources, potentially revolutionising numerous sectors.

What is Tokenomics?

Tokenomics is the study of the token economy, which encompasses token production, distribution, and use within a distributed network. The success of a blockchain or cryptocurrency project is heavily reliant on its foundation.

Tokenomics is essential for any Web3 project that includes digital assets. It can even determine whether a project succeeds or fails. It is critical to have an effective token architecture that offers sufficient incentives for users and token holders to participate in and support a project.

Tokenomics can have an impact on the general health and stability of a network. This is a critical factor to consider when assessing the long-term viability of cryptocurrency or NFT projects.

Today, tokenomics encompasses more than just token economics; it also includes the design and implementation of incentives to encourage the adoption and use of a specific token or platform. This includes staking prizes, referral schemes, bounty campaigns, and more.

Why Does Tokenomics Matter?

Tokenomics is the foundation of most blockchain projects and the determining factor in their durability and sustainability. Let’s look at why tokenomics matters from three angles:

1. For Projects

Tokens are more than just digital assets in blockchain initiatives. They are the driving force. It enables web3 projects to fully fund their activities, including salary disbursement.

This is much more important for programs that operate anonymously. Transacting with fiat currency may quickly reveal the names of stakeholders.

As a result, selecting or developing a token with solid economics is critical to assuring the project’s long-term success.

2. For Investors

The tokenomics of a project can help you determine whether or not an investment is worthwhile. It also provides insight into a token’s liquidity and potential for growth.

Token design and implementation can influence ecosystem distribution, incentives, and governance, all of which can have a direct impact on token value – this is critical for investors.

A fair and decentralised token distribution might result in a more proactive and involved ecosystem, driving platform adoption and usage. This will raise demand for the tokens, driving up their value.

3. For Businesses

Blockchain-based tokens are not limited to web3 projects or cryptocurrency aficionados. Businesses can also profit immensely from them. Tokens enable organisations to generate new revenue streams, improve loyalty programs, implement more effective employee incentive schemes, and facilitate cross-border payments.

Only with the proper tokenomics, in which variables such as emission rates and distribution fit with business objectives, can a company rely on its token to provide genuine usefulness and value to consumers.

For example, when making cross-border payments using cryptocurrencies, businesses may require a token whose price is constant, backed by assets or collateral, and whose reserves are transparent – collateralised stablecoins.

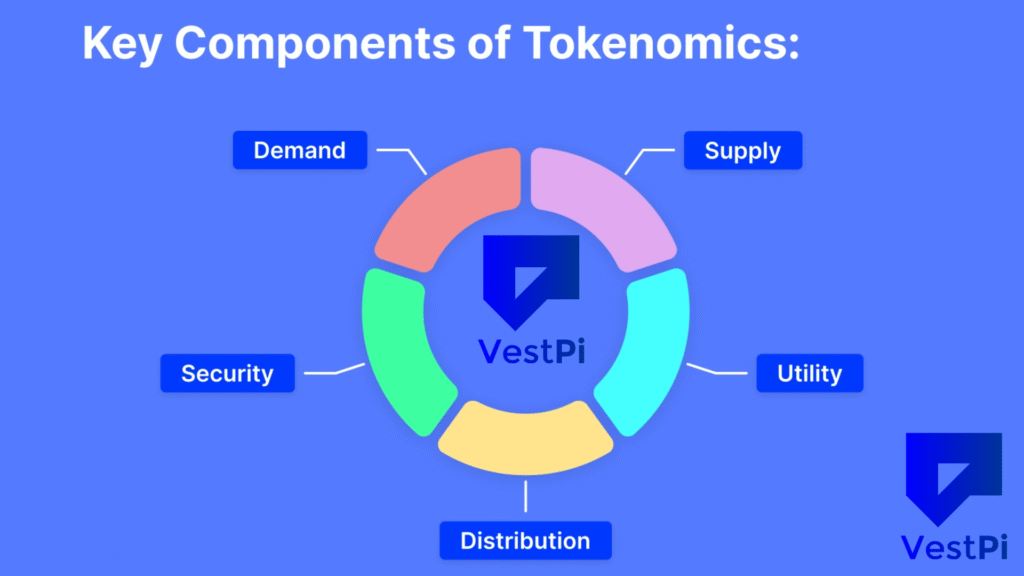

What Are Key Components of Tokenomics?

1. Total Supply

The total supply is the maximum amount of tokens that will ever exist for a given cryptocurrency. This component is important because it establishes the sense of scarcity.

If a token has a limited supply, like with precious metals, it may boost demand and, as a result, value. Some cryptocurrencies, such as Bitcoin, have a capped supply (21 million), whilst others may have an endless supply. Knowing the total quantity can help determine how rare or abundant a token is in the market.

2. Distribution

Distribution describes how tokens are distributed to various stakeholders, including developers, investors, the community, and even reserve monies.

This distribution strategy must be open and equitable in order to preserve trust within the ecosystem. An uneven distribution may result in a concentration of power or wealth, making the token more susceptible to manipulation.

Token distribution details in initial coin offers (ICOs) are crucial for determining their long-term success.

3. Utility

Utility specifies a token’s usefulness and purpose in its ecosystem. Is the token only a store of value, or does it have a specific use in a decentralised application? Understanding a token’s utility can help determine its inherent worth.

For example, some tokens may give voting rights in project development decisions, but others may be used to pay for network services. A token with clear and compelling utility is frequently regarded as a positive signal by investors.

4. Security

The security component of tokenomics is knowing the safeguards in place to protect the token and the entire network. This can include the consensus process (Proof of Work or Proof of Stake), how the network protects against assaults, and the security of wallets and exchanges where tokens are stored.

Security is critical, as weaknesses can result in a loss of funds or faith in the network. Assessing existing security measures and ensuring they satisfy high standards might help an investor avoid potential hazards.

These main components of tokenomics are critical for understanding how a token functions within the blockchain ecosystem. Analysing these elements enables an investor to make well-informed decisions, matching investments to risk tolerance and prospective rewards.

How to Analyze Tokenomics?

Understanding these deep intricacies is critical for any investor seeking to make sound decisions. Here’s how to analyse tokenomics:

1. Research Whitepapers

Most cryptocurrency projects lay out their tokenomics in a document known as a whitepaper. This is frequently the primary source for determining a token’s quantity, distribution, utility, and security.

Investors can learn about a project’s aims and potential value by reading and comprehending its whitepaper in detail. This is more than a quick glance; understanding the concept, technology, and mechanics of the token necessitates a thorough analysis.

2. Check Community Engagement

Community engagement is an important indicator of a project’s health. A thriving and engaged community frequently indicates strong support and belief in the project’s aim.

Investors can use forums, social media channels, and even actual meet-ups to get a sense of the community. Interacting with community members or simply witnessing the debates provides insights into how the project is perceived, potential concerns, and overall sentiment.

3. Evaluate Utility and Demand

Understanding a token’s value requires determining its purpose and functionality inside the ecosystem. Is it simply a speculative asset, or does it serve a specific purpose? Evaluating the token’s real-world application and demand can help determine its intrinsic worth.

For example, if a token is necessary to access a service in a popular decentralised program, it is likely to have physical value. When combined with an estimate of the demand for that service, you can build a sound foundation for investment decisions.

4. Consider the Economic Models

Different projects may employ various economic models, which could include elements like inflation, deflation, or even a hybrid approach.

Understanding these models helps in predicting how the token’s value might behave over time. For instance, a token with a deflationary model may increase in value as the supply decreases, while inflationary models might have the opposite effect.

5. Examine the Regulatory Compliance

Compliance with local and international regulations is crucial and cannot be neglected. Ensuring that the project meets legal criteria can reduce potential legal concerns and boost its legitimacy.

6. Evaluate Real-World Utility

Ensure the token has a clear purpose, huge utility potential, and demand that is based on actual facts, not some baseless hype.

7. Consult with a Financial Expert if Needed

Just like it is often said, “two heads are better than one”. Crypto investments are risky, and professional advice can be invaluable, preventing you from walking into yet another financial miscalculation in broad daylight.

Mistakes to Avoid

- Investing without understanding tokenomics can lead to losses. Avoid these common mistakes:

- Ignoring the Whitepaper: Always read and understand the project’s whitepaper.

- Following the Crowd: Don’t just follow trends; make decisions based on sound analysis.

- Overlooking Security: Ensure the project has robust security measures.

Final Take

Tokenomics is a complex yet necessary component in evaluating cryptocurrency investments. Understanding the complete supply, distribution, utility, and security will enable you to make informed judgments.

Investing without knowing tokenomics can result in losses. Remember to conduct your research, remain current with market developments, and invest intelligently by following these guidelines.

Frequently Asked Questions

Can Tokenomics Change After a Project’s Launch, and How Does This Impact Investors?

Tokenomics might change as a result of project protocol upgrades or governance choices. Such changes may have an impact on the token’s value, utility, or distribution. Investors should stay informed by monitoring the project’s official channels to learn about any changes and assess their possible impact.

How Can I Verify the Authenticity of The Information on A Project’s Tokenomics?

Always consult official sources, such as the project’s whitepaper, website, and reputable cryptocurrency analysis platforms. Be wary of misinformation from illegitimate channels. Participating in community forums and contacting the team directly can also assist in confirming facts.

How Do Forks in A Blockchain Project Affect Tokenomics?

Forks can generate new tokens with varying tokenomics. This could impact supply, demand, utility, and total worth. Understanding the reasons behind the fork, as well as the new tokenomics, will help investors make informed judgments afterward.

How Do Token Burning and Minting Fit Into Tokenomics?

A project’s economic model may include token burning (destroying existing tokens) and minting (generating new ones). Burning can promote scarcity, potentially increasing value, whereas minting might increase supply, thus decreasing value. Both approaches are employed to keep control of a token’s supply and demand dynamics.

What’s the Difference Between a Token’s Circulating Supply and Total Supply in Tokenomics?

Total supply refers to all tokens created, whereas circulating supply refers to tokens that are currently available on the market. Understanding the distinction allows investors to assess scarcity and potential market saturation, which influences investment strategy.

How Does Staking Fit Into the Tokenomics of A Project?

Staking is the process of locking up tokens to support network processes, like as validation. It can be an important aspect of the economic model, influencing supply and demand, incentivising holders, and improving network security.

How Do Governance Tokens and Tokenomics Interact?

Holders of governance tokens can participate in project decision-making processes. Their inclusion in tokenomics demonstrates a dedication to decentralisation and community participation, and they can help shape the project’s path, including modifications to tokenomics itself.

Can Tokenomics Help in Identifying Scams or Fraudulent Projects?

Tokenomics analysis can reveal red flags such as unequal distribution, a lack of obvious benefit, and opaque methods. To assess validity and avoid potential scams, investors should incorporate tokenomics into a larger due diligence process.