When you’re looking at a new token before it’s listed, or just listed—you’re effectively taking on two bets: one, that the token exists (more than just a name), and two, that it will thrive. That second bet? It often depends on the first. This blog post will walk you through how to evaluate a new token carefully, the kinds of red flags to spot, and how to develop your own checklist for smart decisions.

Why This Matters and Why Many Fail

The crypto market is rife with risk and hype. According to research, about a quarter of new tokens are outright scams—pump-and-dump schemes where creators inflate a token’s price and disappear.

When you evaluate a token before listing, you’re in a higher‐risk zone (because fewer facts, less liquidity, more unknowns). But you also have higher potential upside, if you pick well.

That trade-off means: you need more due diligence. You can’t rely on hype alone.

How to Evaluate a New Token

1. The Token’s White Paper & Project Documentation

Before anything else, you have to look at the story behind a token.

What to Check

- Does the project have a white paper or detailed documentation?

- Is the document technical, specific, and credible?

- What problem is the tokenomics solving?

- Does it have a clear Roadmap with stages, dates and milestones?

- Is it founded on realistic claims? For example, any promise of global domination in 3 months is a red flag.

If the white paper and storytelling is weak or vague, the rest of the project may be built on dust. Although a strong documentation doesn’t guarantee outright success, however, weak documentation increases the risk of token dump.

Red Flags

- Lack of white paper, or one that’s a little more than a what you have in the whitepaper.

- Use of generic statements like “We’re going to build blockchain X for everyone globally” without detailing how.

- Typographical errors and poor grammar as well as poor use of citations or source, could signal a rushed or overhyped project.

2. The Core Team, Advisors and Partners

Behind every serious token, there is always a reputable and visible core team working tirelessly on its growth, with no divided attention.

What to Check

- Are the team members visible or trusted individuals in the space when checking top platforms like LinkedIn, twitter, GitHub, including their past projects?

- Do they have relevant experience in blockchain development, social media+community management, product management, and business development?

- Are advisors or partners listed and are they even real and credible in the space?

- Are their project partners verifiable, and not just mere fabrications?

A token with a credible, proven team has a higher chance of delivering. An anonymous or ghost team increases the risk of token dump.

Red Flags

- A team that operates in anonymity with no seen history, nor previous works.

- Advisors that sound impressive but when you dig deep, you find out they aren’t really involved.

- Partners mentioned or listed but no proof of collaboration.

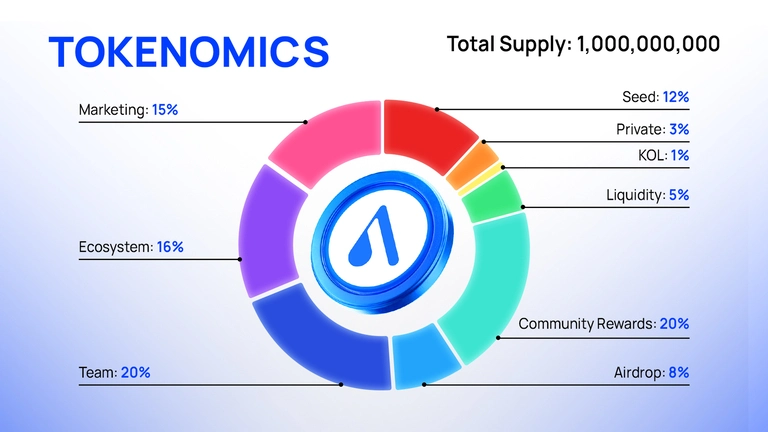

3. Tokenomics, Vesting, and Unlocking Schedule

This is the economic skeleton of the token detailing how token supply, distribution, and unlocks are designed.

What to Check

- What is total supply vs circulating supply?

- How is allocation divided? Do we know their team, investors, community, liquidity, and treasury?

- Are there vesting periods or lock-ups for insiders? Example, does the team unlock tokens gradually?

- Is the utility of the token defined by staking, governance, platform use etc.?

Even a good idea can fail if tokenomics are badly designed. If insiders hold 70% of token supply, it can dump early, and the risk of serious losses increases. And if there’s little utility, demand may vanish.

Red Flags

- Insiders holding a huge portion of the token, thererby increasing the likelihood of an immediate unlock, and at will.

- No clear use case for the token.

- Either the circulating supply is too little, or the total supply is too much, making the risk of dilution sky-high.

4. Community, Marketing and Engagement

Tokens don’t live in a vacuum, they rely on attention, adoption, and trust gathered in the space.

What to Check

- Is there an active community or engagement on Discord, Telegram, or X where you can see real interactions of people asking questions and getting real answers?

- Is there visible developer activity like GitHub commits (if applicable)?

- Does their marketing look credible, one that is not just hype, but substantial?

- Are there meaningful partnerships or media references that can be verified?

A strong community helps drive awareness, trafic and engagement. If the only activity found too litle human conversations, but predominantly hype bots, then the project may well be superficial.

Red Flags

- Large number of followers but little engagement, and such engagements coming from bots or fake accounts.

- Marketing promises with little returns.

- Silence from their team when asked about their marketing budget.

5. Smart Contract, Audits and Security

If the token uses a smart contract as is mostly the case, you’d want to ensure that the code is trustworthy.

What to Check

- Has their smart contract been audited by a reputable firm?

- Are audits publicly available?

- Does the contract address match with what’s available on their project’s website and social media handles?

- Can their liquidity be verified or is it locked, and do they have burn mechanisms?

- Can we use on-chain tools to see token holder distribution, transactions, and their major wallets.

Even if everything else looks good, a faulty contract or malicious tokenomics can destroy value. Example, honeypots, and rug pulls.

Red Flags

- No audit records or auditing done by an unknown firm.

- Contract address that is undisclosed or unverifiable.

- Liquidity not locked, or at huge risk of a dump.

- Token contract allowing buying but not selling, something likened to honeypot.

6. Listing Strategy, Liquidity & Market Timing

A good token needs more than a website and a contract, and it has to be tradeable and accessible.

What to Check

- On what exchanges (CEX, DEX) will the token be listed, and on what timeline?

- What is the planned liquidity, and Is there enough to support trading without massive slippage?

- Are there lock-ups for liquidity providers or mechanisms to prevent early dump?

- Is the timing right relative to market conditions, competition, and adoption?

A token might look great, but if it has no market or liquidity, its value can get stuck. Also, early dumping by insiders or community can tank token value fast.

Red Flags

- Token listing only on unknown exchanges with almost no liquidity.

- No communication of listing date, and with vague timeline.

- No mention of liquidity locks or token protections.

7. Watch Out For Token Red Flags

Here are some things that consistently show up in failed or scam projects. They aren’t always fatal, but they increase the likelihood of looming trouble.

- Anonymous team with no transparency.

- Unrealistic promises like a 100% return on investment in one month, and with zero risk.

- Tokenomics where insiders hold too much and unlocks are instantaneous.

- No utility for the token, and if it exists, it is just for trading.

- No audit records, or auditing done by questionable firms.

- Heavy Marketing despite little token potential, backed by a lot of hype, and little project development.

- Low liquidity, and listing on untrusted or relatively unknown platforms alone.

- Sudden big announcements without proof, backed by airdrop promises that sound too good to be true.

8. Build Your Personal Checklist

Here’s a simplified version you can print, carry, or revisit before considering a new token:

| Check | What to ask |

|---|---|

| White Paper / Documentation | Does it make sense? Clear roadmap? |

| Team and Advisors | Are they real, public, experienced? |

| Tokenomics and Supply | Who holds what? Vesting schedule? Utility? |

| Community and Engagement | Is the community active and real? |

| Audit and Contract | Are their audits available, contract address verifiable, or liquidity locked? |

| Listing and Liquidity | Where’s it going live? Is their liquidity sufficient? |

| Market Timing and Use Case | Does this token solve a problem or ride a wave? |

| Red Flags | Are any of the warning signs present? |

9. Token Must Be Have A Convincing Story: Case Study

Let’s walk you through a hypothesis. Imagine a token called EcoChainToken (ECT) which claims to enable carbon-credit trading on a new blockchain.

- White Paper: They published a 40-page doc, showed how their chain will link with IoT sensors for carbon capture. That’s a good sign.

- Team: Founders are listed; one has prior experience at a green-tech startup, and the other worked on a blockchain infrastructure. They have transparent profiles.

- Tokenomics: Total supply is one billion ECTs; token circulation at launch is 100 million, and their team gets 15% token locked for 12 months, then vests for 24 months, and the community gets 30%, while their partner-treasury gets 20%. That looks decent.

- Community: Active Discord with 5,000 members, and their team hosts AMAs weekly and answers questions.

- Audit: Smart contract audited by a recognised firm, and their liquidity lock lasts for 6 months.

- Listing: Going live on two mid-tier exchanges and a DEX, signaling that they’re transparent about their listing date and initial liquidity.

- Use Case: Real-world: Their carbon-credit market is large, with rising interest. They have a pilot partnership with an established green tech company.

- Red Flags? They have no major red flag so far. Despite being an early risk, this one checks many boxes.

From this story, you can see that while nothing is guaranteed, you’d feel relatively more comfortable with ECT than with a token that lacks most of these features.

Final Thoughts

Even the best tokens may fail. As a result, early coins are high-risk, so only invest what you can afford to lose. Instead of focussing just on one project, diversify your portfolio. Keep an eye out for unlocks/unvestings, since large dumps frequently occur after token unlock events.

Stay informed – watch project progress, community buzz, and have an exit strategy. It is important that you understand this in advance, whether or not you are looking for a short-term trade or a long-term hold.

Evaluating a new token before listing isn’t about spotting the next “10-bagger” (though it may occur). It is about distinguishing between ventures with true potential and those based on hype and optimism.

Use the following framework; document review, team credibility, tokenomics, community engagement, security, listing strategy, and warning signs. If a token fails many of these tests, you may have to opt out.

In cryptocurrency, doing your homework pays you. The noise can be deafening, yet the details switch to stillness. The projects that succeed are those in which groundwork meets execution.