For blockchain networks, especially Ethereum, scalability is still a major obstacle. Ethereum, which serves as the primary hub for developer activity, DeFi, and decentralized apps (dApps), is experiencing an existential crisis due to congestion and high gas costs, which make transactions more costly and slower, raising concerns about the network’s sustainability.

Layer 2 networks are one of the breakthroughs currently in use, and finding scaling solutions for Ethereum has been a major driving force behind development. By performing some of the computing effort elsewhere, these seek to relieve the main blockchain.

In general, side chains and rollups are the two main types of layer 2 scaling solutions. This post will concentrate on rollups, elucidating the difference between zk rollup and optimistic rollup techniques and their implications for you, the user.

Optimistic vs ZK-Rollups – An Overview

ZK-rollups and optimistic rollups are both intended to scale Ethereum by lowering the main chain’s processing burden. They do, however, approach transaction verification and other operational issues differently. How they verify the legitimacy of transactions prior to sending them to Layer 1 is the primary difference between the two kinds.

By boosting transaction throughput and cutting expenses, layer-2 solutions aim to mitigate the drawbacks of layer-1 blockchain networks. These systems manage transactions off-chain before settling them back on the main chain. They function on top of current blockchains.

By doing this, they greatly improve the network’s scalability, enabling a more effective transaction process. ZK-Rollups and Optimistic Rollups are two of the most prominent layer-2 solutions; each uses a different strategy to accomplish its objectives.

Gaining an understanding of each mechanism’s impact on the blockchain ecosystem requires an understanding of how it operates.

What Are Layer 2s, and Why They Matter?

Since demand for blockchains like Ethereum and Bitcoin has been steadily increasing, these networks can quickly surpass capacity during periods of strong demand, resulting in congestion and, ultimately, expensive user fees. Because of this, these networks are costly, slow, and ineffective for widespread use.

At the moment, networks such as Ethereum can process up to 15 transactions per second (TPS) with fees as high as $40. To put this in perspective, VISA typically handles about 1,700 TPS, but it can handle up to 65,000 TPS.

In order to solve the scalability issues Layer 1 chains encounter without sacrificing the fundamental principles of security and decentralization of the foundation layer, Layer 2 networks are protocols constructed on top of a Layer 1 blockchain, like Ethereum.

While other Layer 2s, like Starknet, address blockchain’s UX issue with their native account abstraction, we’ll concentrate on scaling in this essay.

When we discuss how Layer 2s increase blockchain scalability, we are mostly focusing on two major enhancements: increasing throughput and cutting expenses.

- Increasing throughput: Only the final state or a summary is recorded on the main chain since transactions are combined into a single batch, and the majority of computation is done off the main blockchain. As a result, the Layer 1 blockchain’s workload is decreased, and transaction throughput is increased overall.

Additionally, Layer 2 solutions lower the delay involved in establishing consensus on the main chain by managing transactions off-chain. Higher throughput and faster transaction confirmations are made possible by this.

- Cost reduction: Because the fixed cost of a Layer 1 transaction is dispersed over numerous smaller transactions, Layer 2s are able to lower the costs related to on-chain transactions by carrying out transactions off-chain and relieving the pressure on Layer 1. This results in a lower average cost per transaction.

Types of Layer 2s

Although Ethereum offers a variety of Layer 2 technologies, including state channels, plasma, and validium, rollups are the most often used. There are two types of rollups: validity rollups (also called ZK rollups) and optimistic rollups.

Rollups typically carry out transactions off-chain, group them together, and handle them as a single Layer 1 transaction. As a result, the network’s capacity is increased, congestion is decreased, and a large portion of the expense related to this laborious computation is eliminated.

The kind of proof that optimistic and ZK rollups employ to verify transactions before their settlement on L1 is the primary distinction between them.

- Optimistic rollups: Until the contrary is demonstrated, optimistic rollups assume that every transaction that is carried out, batched together, and delivered to the base layer is legitimate. Optimistic rollups serve as a security barrier by giving anyone on the network up to seven days to contest a recently filed transaction by providing “fraud proof,” which establishes the transaction’s invalidity. Transactions are re-executed, and the rollup is updated if the transaction is found to be invalid.

- ZK-rollups: In contrast to optimistic rollups, ZK rollups use “validity proofs,” often referred to as “ZK proofs,” to confirm the legitimacy of each and every transaction that has been carried out and grouped together. This validity proof, alongside a summary of the state update, is then forwarded to the base layer for final decision.

How Do Optimistic Rollups Work?

Since optimistic rollups assume transactions are valid unless they are contested with a fraud proof, the process for finalizing a transaction on the base layer differs from that of a ZK rollup. Here’s a more thorough breakdown of how optimistic rollups function:

- Off-chain execution: On the Layer 2 optimistic rollup, transactions are carried out off-chain.

- Transaction bundling: To send completed transactions to Layer 1 for settlement, they are grouped together.

- Batch submission: Transactions are optimistically received by verifiers of the optimistic rollup on Ethereum, but they are not finalized until after a dispute period, often known as a “challenge window,” which can last up to seven days.

- Finality and settlement: The transaction batch is deemed concluded if the dispute time passes without any disagreements or if disagreements are settled. At this stage, the Ethereum mainnet settles the transactions’ final status, updating the blockchain’s global state.

- Dispute period: If a transaction is found to be invalid during this time, it is contested on the Ethereum mainnet. Verifiers are incentivized to ensure transaction processing correctness since they risk losing their staked funds if they validate fraudulent transactions.

- Data availability: Because optimistic rollups don’t broadcast proofs with transaction results unless a transaction is contested, they only release a small amount of data on the Ethereum mainnet.

- State updates: The main chain modifies the state based on the results of the transactions following a successful verification. This entails updating token transfers, account balances, and other pertinent modifications that show the results of the completed transactions.

How Do Zk Rollups Work?

While both optimistic and zk rollups are designed to increase throughput and reduce transaction costs on blockchains like Ethereum, they achieve these goals through different mechanisms. As seen above, optimistic rollups achieve this by assuming transactions are valid unless they are challenged with a “fraud proof”.

ZK rollups, on the other hand, use “validity proofs”, or ZK proofs, to validate the correctness of each batch of transactions sent through to the base layer. Here’s a detailed breakdown of how ZK rollups work:

- Off-chain execution: Transactions are executed off-chain, on the Layer 2 ZK rollup.

- Transaction bundling: Executed transactions are batched together into a single proof that attests to the validity of every transaction in the batch.

- Batch submission: This proof, along with a state difference (the difference between the state of the previous batch and the next one), is submitted to the L1 as a single block for verification.

- Verification: Upon receiving the proof, a verifier on L1 confirms the validity of the transactions using cryptographic techniques, without the L1 having to execute them itself. This saves time and computational costs.

- Finality and settlement: Once approved by the verifier, transactions are settled within just a few hours-unlike on optimistic rollups-and the L1’s global state is updated. This means users are able to access their funds within just a few hours via ZK rollups, instead of having to wait up to seven days via optimistic rollups.

- Data availability: Because ZK rollups only send the validity proof and state difference to the base layer, they don’t use as much L1 data as individual L1 transactions.

- State updates: After successful verification, the L1 updates the state according to the transactions’ outcomes. This includes updating account balances, token transfers, and other relevant changes reflecting the effects of the executed transactions.

The Difference Between Optimistic and Zk Rollups

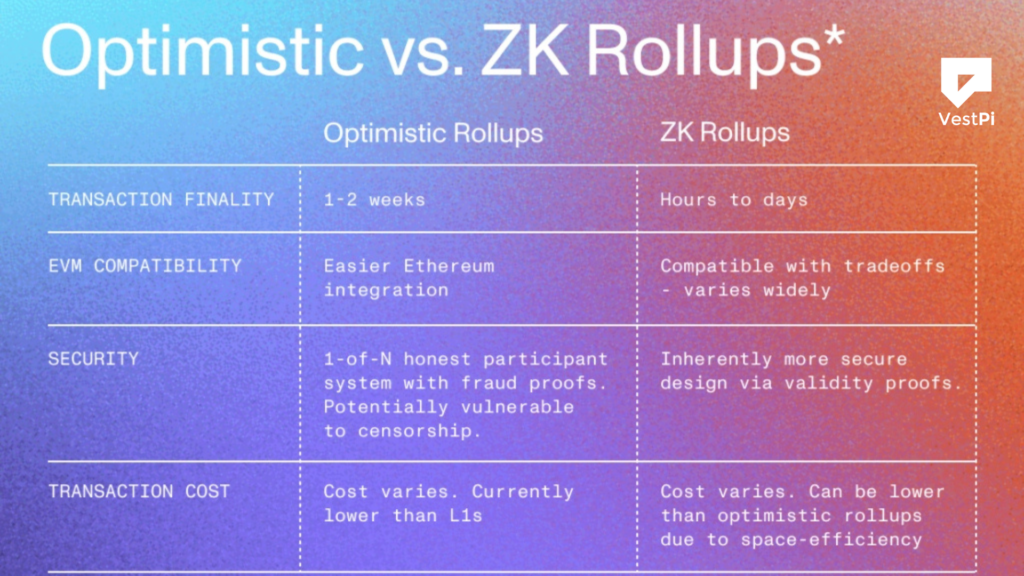

Here is a quick comparison of their core differences:

| Feature | Optimistic Rollups | ZK-Rollups |

|---|---|---|

| Validation Method | Assume transactions are valid unless challenged | Use cryptographic proofs to verify transactions |

| Finality Speed | Slower due to fraud-proof challenge period | Faster because proofs are verified instantly |

| Security Model | Relies on fraud proofs to detect incorrect transactions | Uses Zero-Knowledge Proofs (ZKPs) to ensure correctness |

| Computation Requirements | Lower computational costs but longer withdrawal times | Higher computational costs but faster execution |

| Main Use Cases | General-purpose dApps, smart contracts | High-frequency trading, payments, identity verification |

Different strategies are used by optimistic rollups and ZK rollups to accomplish scalability, security, privacy, and other crucial elements. The main distinctions between different metrics are shown in the following table, which also offers information on their advantages and disadvantages.

Pros and cons

Let’s examine the benefits and drawbacks of each strategy now that we have a better grasp of the distinctions between optimistic and zk rollups.

Optimistic rollups

Pros:

- High throughput: By processing transactions off-chain and reducing base layer congestion, optimistic rollups greatly increase blockchain throughput.

- Cost-effective: By reducing computation on Layer 1, optimistic rollups lower transaction fees and increase the accessibility of decentralized apps.

Cons:

- Slower finality: Transactions on optimistic rollups are subject to a dispute period prior to Layer 1 settlement, which causes a significant delay in transaction settlement. For instance, it may take up to a week to withdraw cash.

- Less secure: Optimistic rollups demand a degree of faith in network users because their security relies on rewarding honest verifiers to identify fraudulent transactions and actively submit a fraud proof during the dispute period. They are therefore less secure than ZK rollups, which offer cryptographic certainty for each transaction’s legitimacy from the outset.

Zk Rollups

Pros:

- High throughput: By processing transactions off-chain and reducing L1 congestion, ZK rollups dramatically increase blockchain throughput.

- Expense-effective: By distributing the expense over numerous smaller transactions, ZK rollups minimize transaction fees by lowering computation on L1.

- Faster finality: ZK rollups enable finality on L1 in a matter of hours because they do not have a challenge period.

- More safe: ZK rollups not only inherit the L1 blockchain’s security and decentralization, but they also offer cryptographic certainty for transaction validity, reducing the need for trust and guaranteeing data integrity.

Cons:

- Complexity: Due to their specialized nature, many ZK rollups require education and infrastructure development to integrate them into existing blockchain ecosystems.

Which Rollup Is Better?

The decision between ZK rollups and optimistic rollups ultimately comes down to the particular requirements and priorities of a particular application. ZK rollups are a great option for applications that need high security and instant confirmation because of their cryptographic proofs, which provide greater security and instant transaction finality.

They do, however, come at the expense of increased computing needs and complexity. Optimistic rollups, on the other hand, are more adaptable and simpler to deploy, which makes them ideal for a wider range of applications, especially those that can accept a little finality delay because of the challenge phase.

Developers and users will gain from both options as the ecosystem and technology surrounding them continue to develop, utilizing the distinct advantages of each to improve efficiency and scalability.

Closing Remarks

Although they serve different purposes, both optimistic and ZK-rollups significantly increase Ethereum’s scalability. While ZK-rollups offer speedier finality and higher security, making them appropriate for financial applications, optimistic rollups offer simpler integration and lower costs, making them perfect for ordinary dApps.

The user is the obvious winner in the competition between optimistic and ZK-rollups. With Layer 2 scaling options like Arbitrum, Optimism, zkSync, StarkNet, and many more, now is the ideal time to investigate the larger Ethereum ecosystem.